During the last fortnight, we have seen further easing of restrictions as ‘normal’ life starts to return. The Government has outlined details of their construction stimulus policy with a heavily means-tested $25k handout to first home buyers and cashed up renovators. While pundits debate the wisdom of such a targeted stimulus package in the residential sector, we retain our focus on the fortunes of commercial construction.

This sendout will focus on how businesses are changing their tendering tactics. It follows on from a newsletter we sent out two weeks ago with data taken from a survey we conducted (you can read it here.)

What we’re seeing

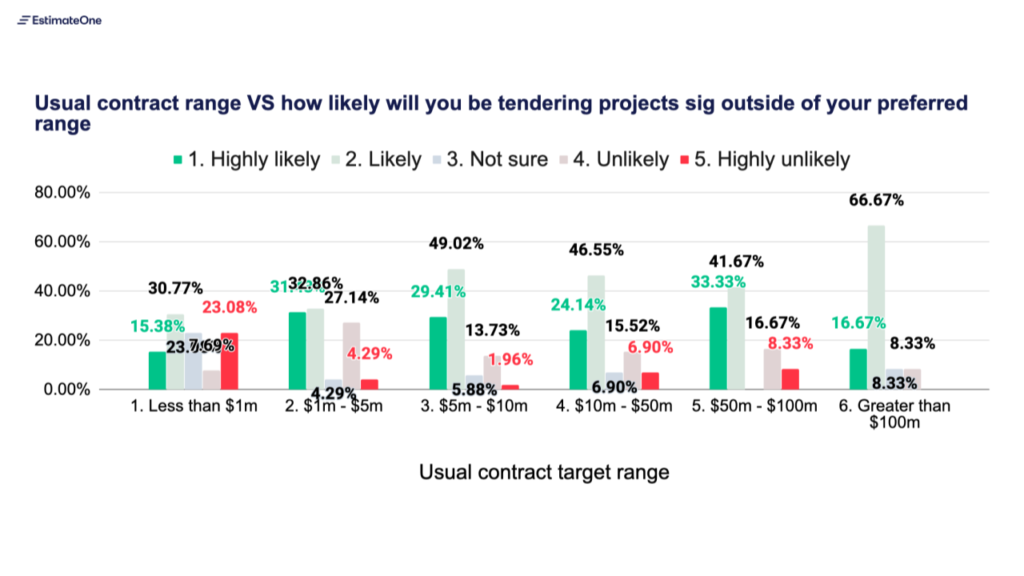

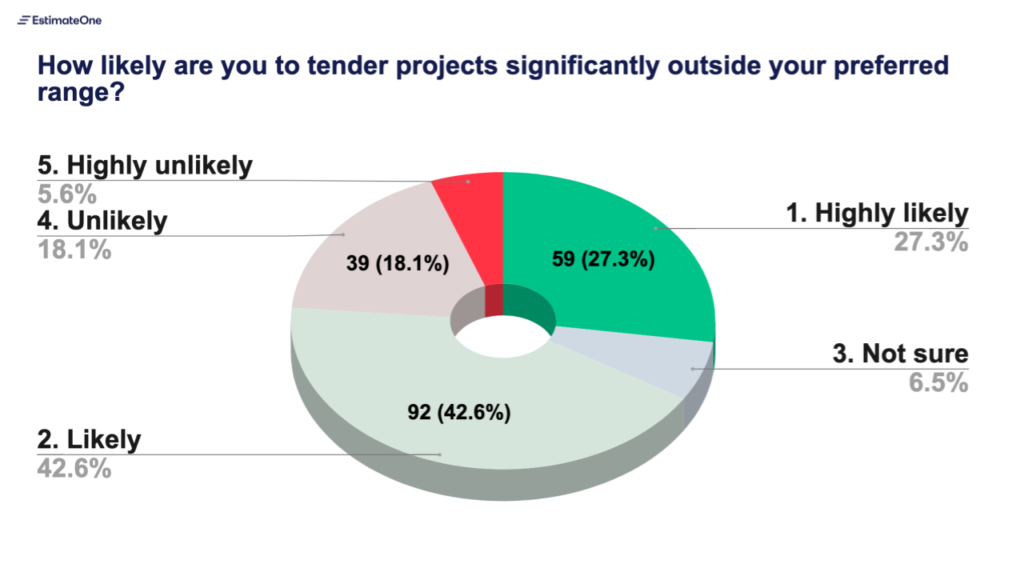

Section 1: Likelihood of tendering projects outside preferred contract value range:

Commentary:

- More than two thirds of our respondents anticipate they will be tendering significantly outside their preferred range in the coming twelve months.

- The higher the preferred contract value range, the more likely the respondent is to anticipate tendering outside of that range.

- Builders are signalling an intent to follow the work: while it isn’t financially desirable for larger builders bid on projects with smaller contract values, it’s a sign that there are less projects available in their target contract range.

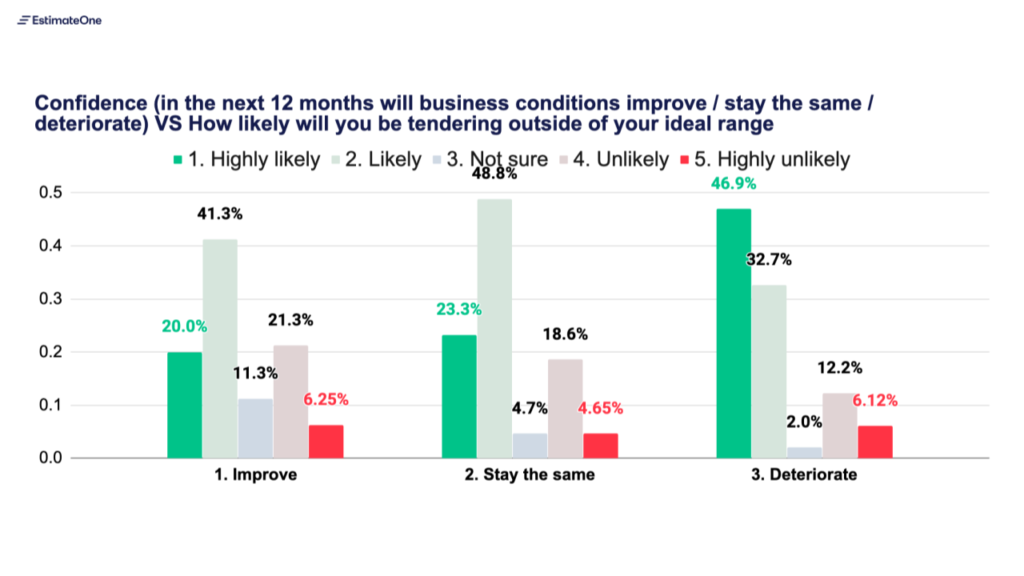

Commentary:

- Businesses who predict market conditions will deteriorate are the most likely to predict they’ll be tendering on jobs significantly outside their contract range.

- These respondents appear to be flagging pro-active changes in the way their business operates. They are signalling a need to be flexible in the face of worsening industry conditions – seeking an extra leg to stand on in a competitive market.

Section 2: Competitive tender panels:

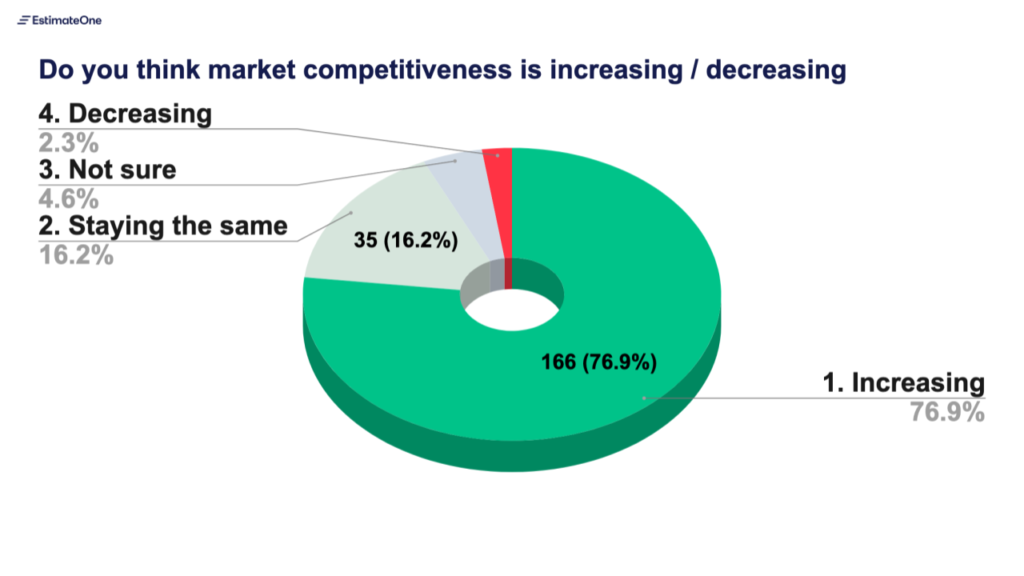

Commentary:

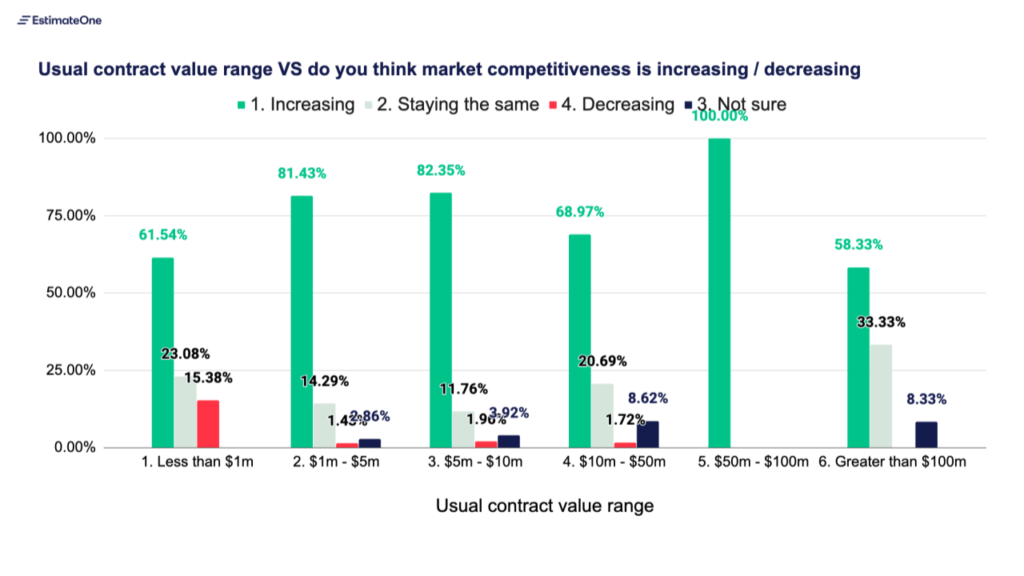

- Like our data suggested in a previous newsletter (link), over three quarters of respondents feel that market competitiveness is increasing.

- Builders who prefer to work with $1 – $10m and $50 – $100m contracts are most likely to note an increase in competition.

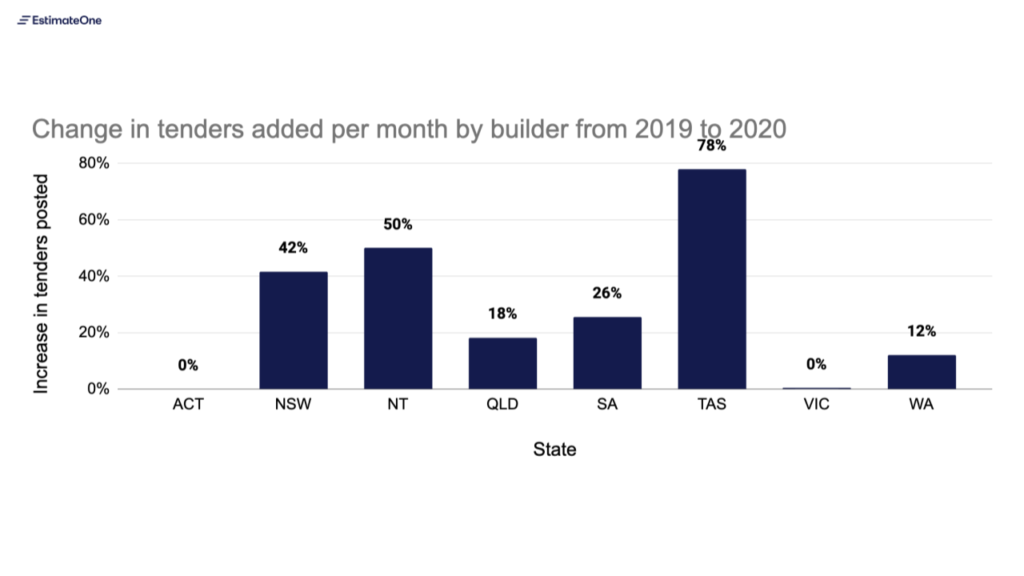

- Below we show a graph showing how builders are increasing the number of projects they are tendering per month. It is likely that the increase of competitiveness in these value ranges is a result of builders upping their tender load in areas where the work currently is.

Commentary:

- This chart shows the change in the number of tenders per month by a given builder, comparing 2020 to 2019. It includes only those builders who tendered in both years (so doesn’t reflect the effect of new entrants or business closures).

- Builders in the majority of states have increased the amount of tenders they bid on per month. With the total number of projects tendered on EstimateOne returning to more normal levels, the increased competitiveness appears to be driven by the market.

What we’re hearing:

Businesses are starting to feel the pinch of competitive tender panels.

- A builder who tenders on contracts under $1m told us that he’s seen an increase in competition on government and residential tender panels. He also told us about an education job he recently tendered on where 30 builders showed up at the site inspection and 20 ended up on the tender panel.

- A survey respondent from Queensland also lamented the more competitive tender panels. They noted that some project panels were now in excess of 10 builders and predicted that the market will remain depressed for the foreseeable future.

- Several builders have told us that selective tender panels have increased from an average of 3-4 builders to 6-7.

More subbie prices are coming in as the fear of underpricing grows.

- One estimator from Queensland told us that he’s seen an increase in subbie quotes coming in – which for him is the canary in the coal mine for market competitiveness.

- Someone had also noted that residential builders are starting to pop up on comercial tender panels. On these jobs they bring their own residential subbies, who are able to quote the work for less.

- “The cost of building hasn’t decreased,” one survey respondent told us. In order to meet the price of the market and get on site, people are quoting much less. The respondent stipulated that the effects of under-pricing will come back to bite the industry in the next six months.

- One builder we spoke to also mentioned that he believes some clients are using the current market conditions to their advantage. He believes clients are looking to lock in lower prices now with no intention to proceed with the build in the near future.

Businesses are becoming much more flexible in order to adapt to the change.

- As a result of increased competitiveness, builders are starting to expand into different sectors in order to lock in any work.

- A builder from New South Wales told us that they’re “seeking any opportunity in any value range to keep people employed”.

- Builders have also let us know how they are diversifying the project sectors they are bidding on. Some builders who would only bid on private tenders have noted they are now bidding on public ones as well.

- Having to work from home is also a reality many builders faced. Some have noted how going forward this will be offered to staff permanently. Adopting new technologies such as zoom was important to ensure collaboration remained in place.

Last week we reached out to everyone with a call to arms to help supply data for our next newsletter. We’re grateful for the more than 200 builders who shared their thoughts within the first 24 hours.

The respondents were not only generous with their time, but also with the level of detail they were willing to go into with their insights. It’s a real joy to see how our industry is banding together to help eachother out in these times.

We’ll share the results over two newsletters, with this sendout focussing on industry confidence and the government’s plan to use construction as a lever to stimulate the economy.

What we’re seeing

Section 1: Industry Confidence

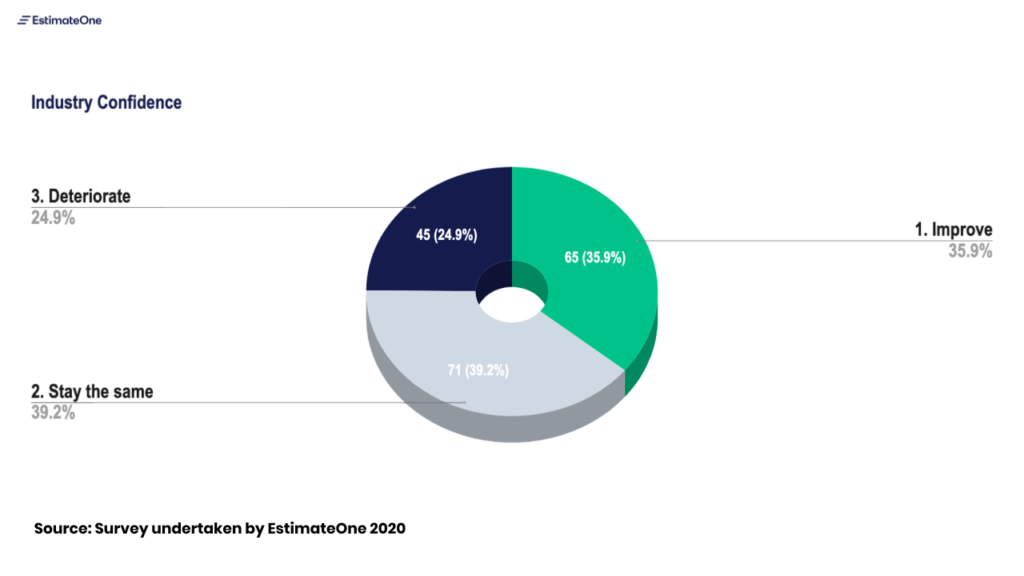

Question: Over the next 12 months, for your business do you think things will…

As we saw in our analysis of COVID-19 impacts by state and sector, fortunes in the industry are mixed with some bearing the brunt more than others. Confidence is split, though a greater share still expect improvement in conditions compared to those who foresee a deterioration.

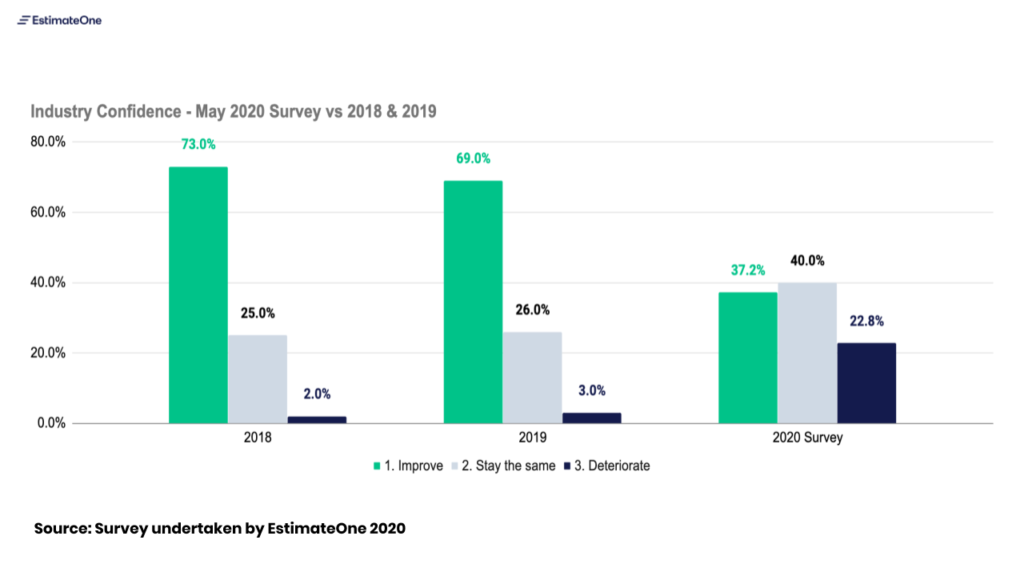

We’ve asked this question before as part of our annual industry survey. Here is how it looks when compared to the same question being asked in 2018 and 2019.

Commentary:

- A ten fold increase in people thinking that business conditions will deteriorate in the next 12 months re-enforces the anecdotal evidence we’re hearing; the initial panic has subsided, but much of the industry feels the toughest times are yet to come.

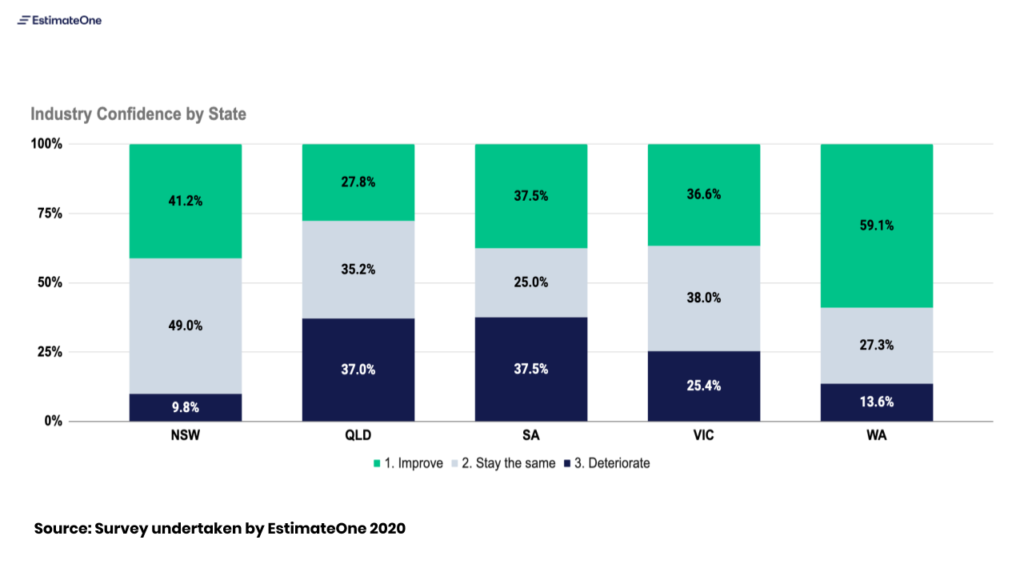

Commentary:

- Industry confidence is down particularly in Queensland. The increase in competition on Queensland panels we showed in our last newsletter could be a contributing factor to this result.

Section 2: Government stimulus:

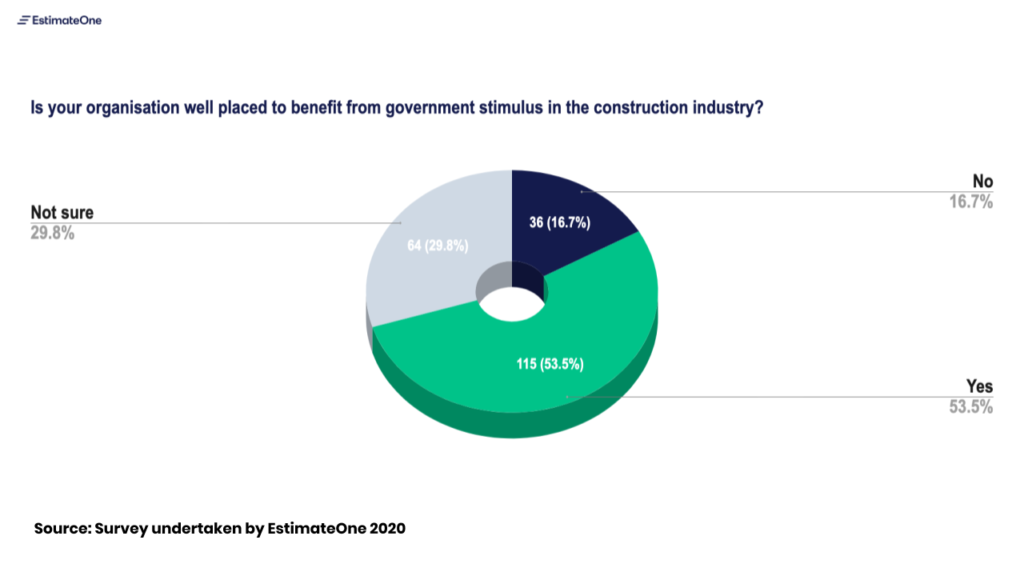

Question: Is your organisation well placed to benefit from government stimulus in the construction industry?

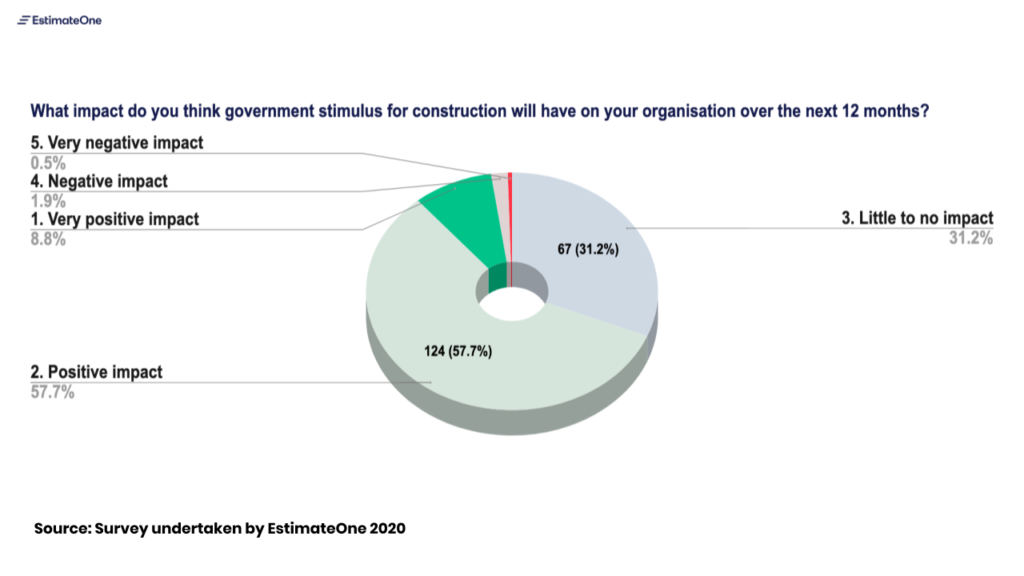

Question: What impact do you think the government stimulus for construction will have on your organisation over the next 12 months?

Commentary:

- A third of those who responded to the survey believe that the stimulus will not effect / have a negative effect on their business.

- Expectations around business confidence were linked to builders’ views on the stimulus; 55% of responders who said at the start of the survey they expect business conditions to deteriorate, believe that the stimulus will have no effect / a negative effect on business.

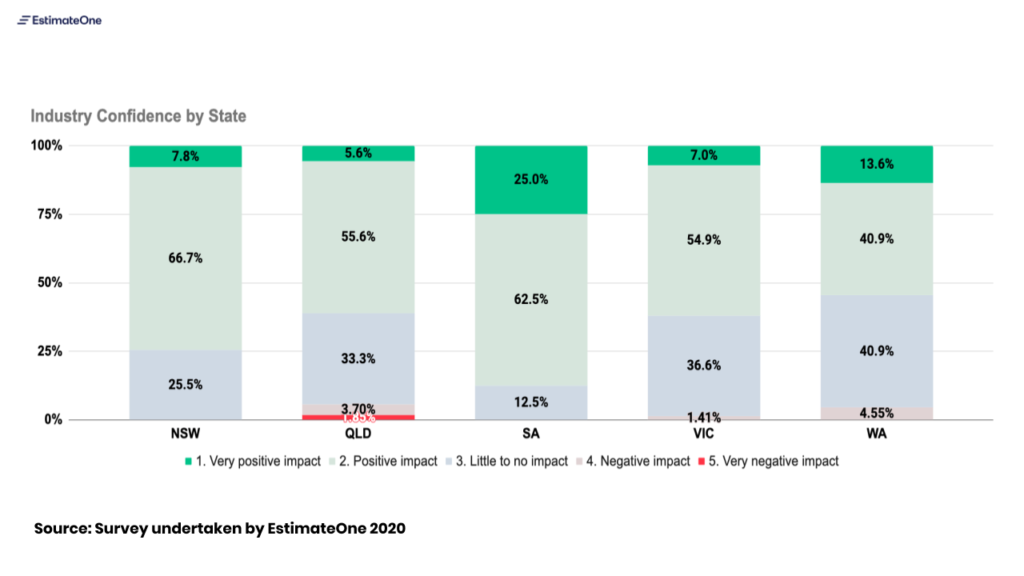

Commentary:

- Responders in states like NSW (link) and VIC (link) who have started announcing details around planned stimulus policy have the highest confidence that their business will benefit from the packages.

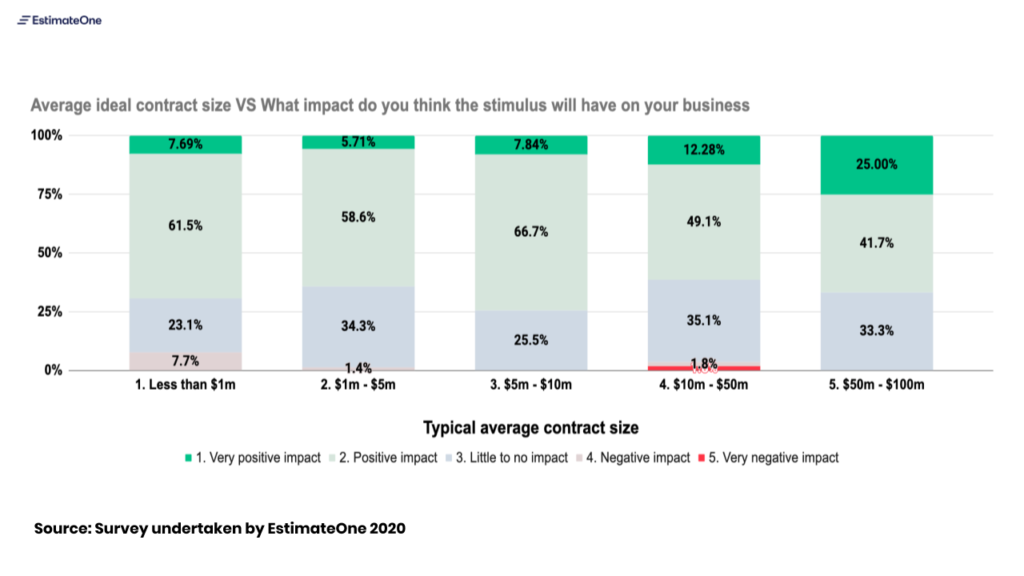

Below is a split of what impact businesses think the stimulus packages will have based by the value of contracts they typically work on.

Commentary:

- We can see that builders who typically work on larger contracts are more confident that they will benefit from the stimulus.

- Conversely, builders who work on smaller contracts are more likely to say that the stimulus will have a negative effect on their business.

What we’re hearing:

As the above data suggests, the government’s plan to use construction as a lever to stimulate the economy has been met with mixed opinions. We gave our responders the option of writing down why they answered the question in a particular way – this has given us the chance to provide deeper insight into the way the industry is feeling.

Many feel the stimulus is geared towards tier one or two builders:

- Many of our respondents wrote to us fearing the lion’s share of the stimulus packages will go to the larger builders.

- One responder claimed that “a lot of projects are in large bundles for the multi-national builders”

- Another responded “The stimulus package will most likely only help the Tier 1 and larger contractors, not the mid tier”

- One responder was hopeful that this stimulus would trickle down to the tier 3 and 4 builders, but expected that to be at least 12 to 18 months away.

- These sentiments could be based on experience, as this is somewhat like what we saw with the Building the Education Revolution (BER) stimulus in the wake of the GFC.

- $16 billion worth of stimulus work was released quickly to the market. The lion’s share of the school packages were awarded to the nation’s largest builders, due in part to the government’s desire to deliver the stimulus to the market quickly via packages of a hundred schools at once.

- In some instances, this resulted in unnecessary levels of additional project management and wastage of funds.

Some feel that the construction stimulus won’t be in the fields they typically operate in.

- One person noted that policy amendments such as the first home buyers scheme will benefit project builders but not those who work on more bespoke / commercial works.

- One noted that they believe the majority of the funds would head to regional areas where their business doesn’t have the subbie contacts required to put in a competitive quote.

- A concern was also shared that these packages will attract their regular subbies to infrastructure works, leaving them at risk in their current tenders / and future awarded tenders

Some worry the stimulus could exacerbate the problem of under-pricing:

- One responder told us: “You still need to win the work, potentially of all the contractors that can complete those projects, there will be a few that will do it for nothing, making it difficult for the majority to win the work.”

- Another responder stipulated that all the stimulus work will have a lot of businesses flocking to it – thus increasing the competitiveness in price required to win it.

Those who are ready / willing to adapt are confident in what the future has to bring.

- A lot of responders wrote that they are confident their business will benefit, as they have gone through all the necessary procedures to complete government work in the past.

- One person wrote “We are restructuring our company to be able to undertake more government work.”

- Quite a few responders also were confident as they had won a lot of education jobs in the past. With education likely to be the lynchpin of many policy announcements, these builders are confident they’ll be able to take advantage of the upcoming packages.

Much of Australia are heading to work this week riding a wave of positivity as lockdown laws begin to be wound back. Our tender noticeboard is also showing signs of positivity with tender volume levels reaching pre-COVID heights.

However on both fronts there is cause for caution. Just as health authorities prepare for a second spike in cases, our clients are telling us they’re preparing for an industry dip down the road.,

In this newsletter we take a look at competitiveness, and unpack how the lower volume of tenders since COVID-19 might be causing an increase in competition on the tenders that are now closing.

What we’re seeing

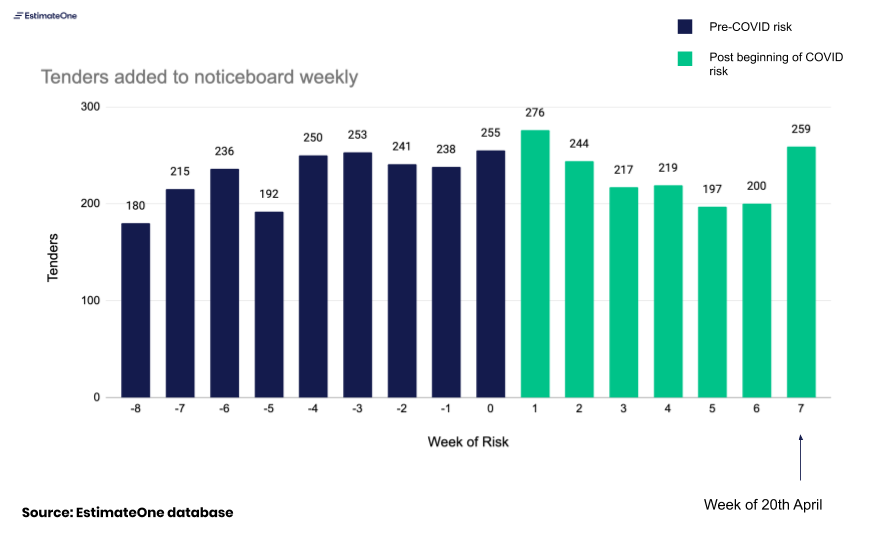

Section 1: Aggregate new tender volumes:

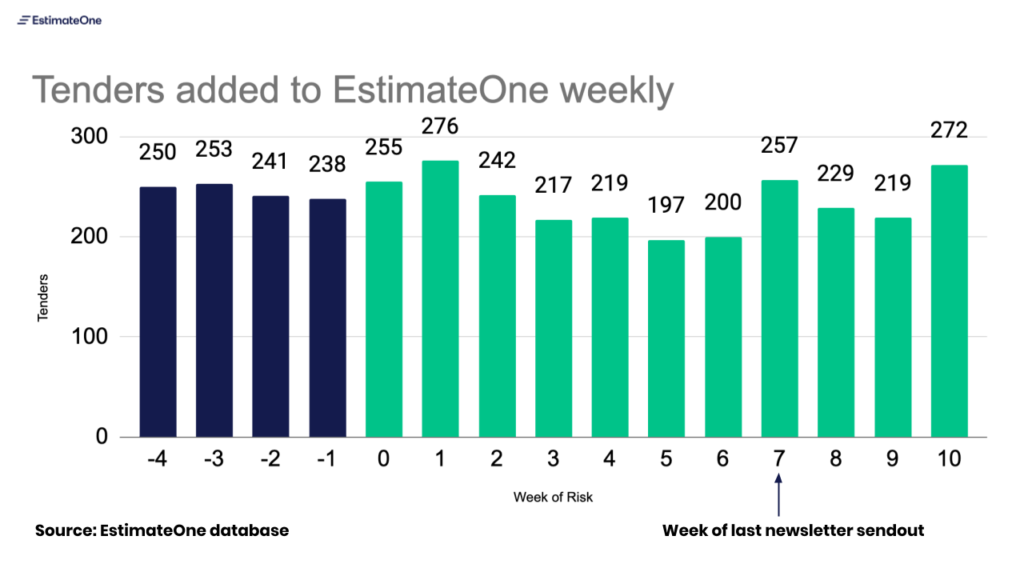

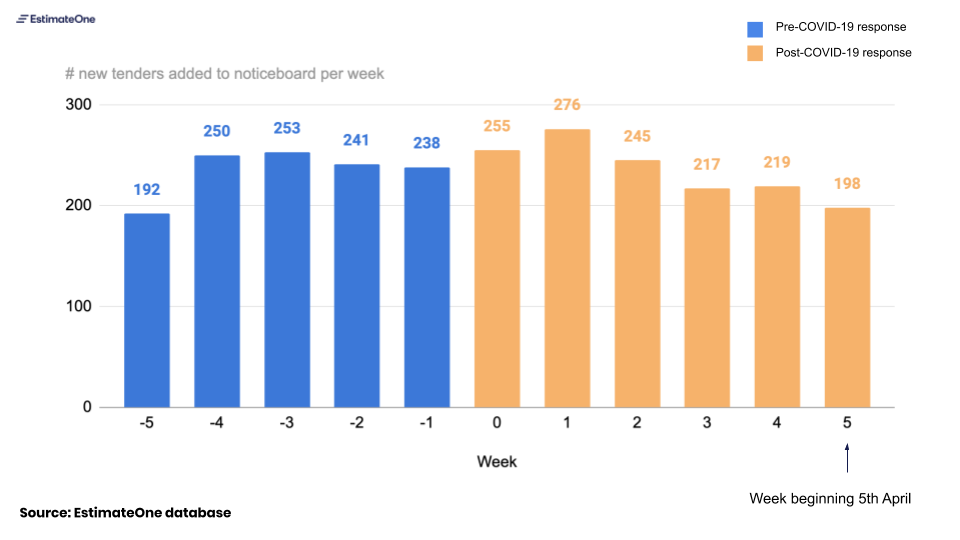

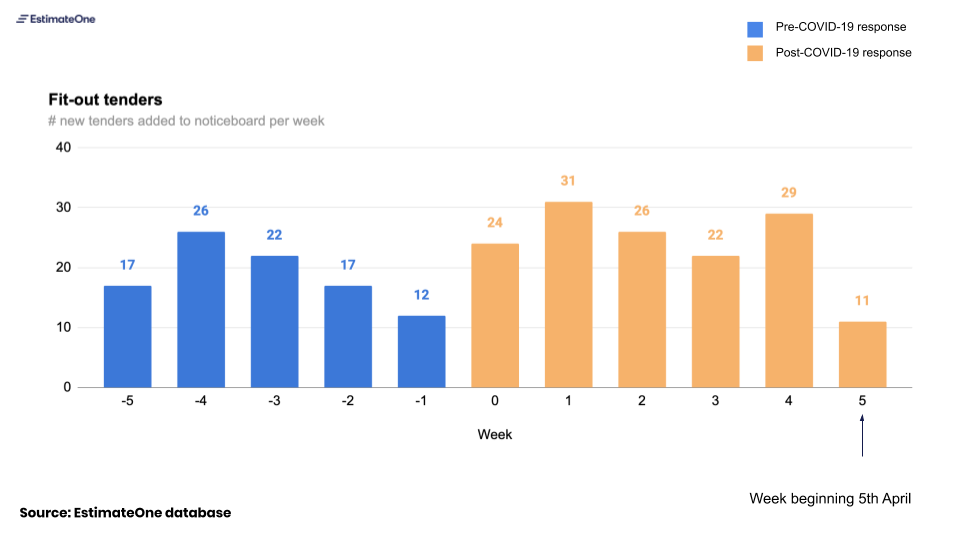

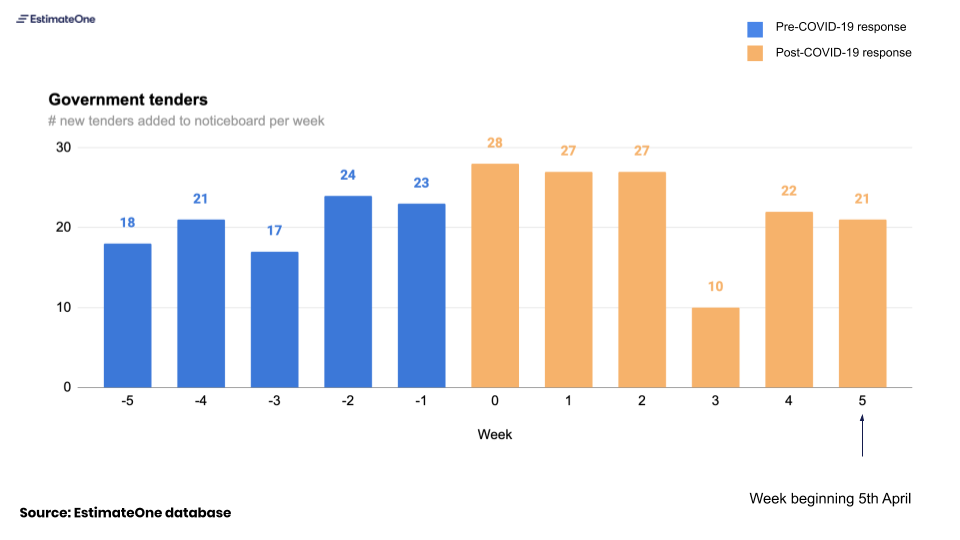

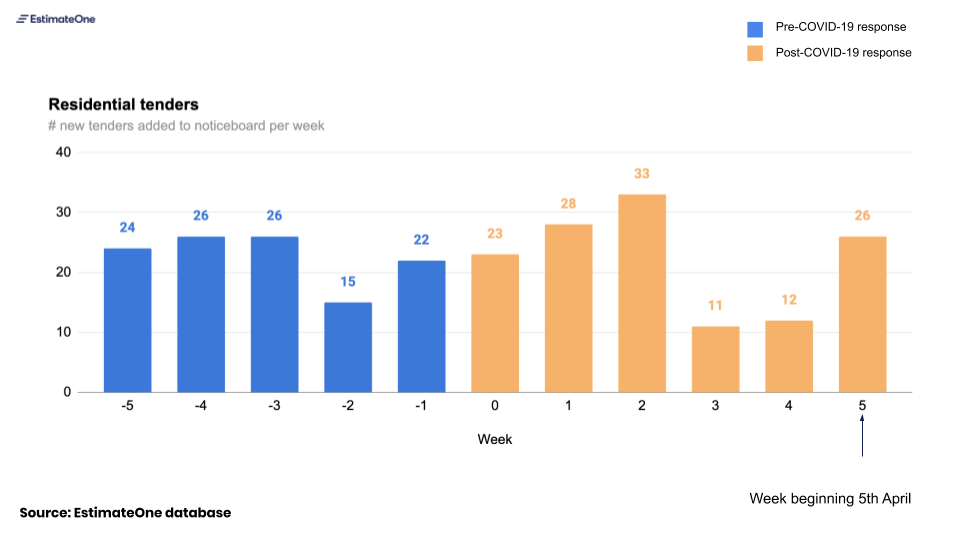

Commentary:

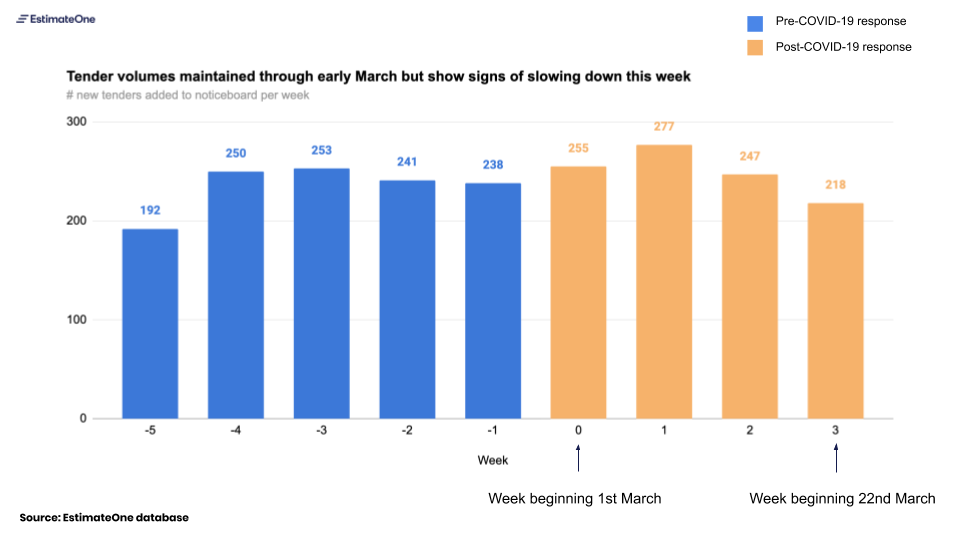

- Week 0 represents the first Federal Government response to the pandemic, so you have to look to week 3 for when the strictest lockdown policies began.

- Last week we saw the most tenders added to the noticeboard since the lockdown restrictions began.

- Tenders in the Government, Commercial and Education industries continue to be the strongest performers throughout the pandemic.

Section 2: Tender competitiveness:

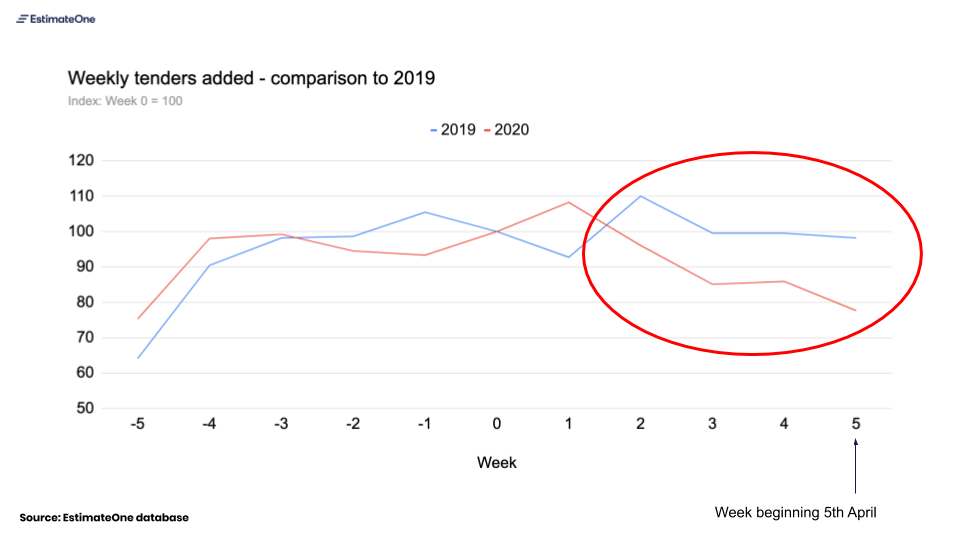

While we are starting to see an uptick in tenders in the last couple of weeks – we are also now starting to get a picture of how the dip in tenders affected the market.

Throughout this time we saw an increase in the number of builders on each tender panel. We attribute this to a potential combination of a couple of things;

- There are less tenders on the market to quote on, and,

- Builders are looking to sure up their work pipeline ahead of an uncertain future.

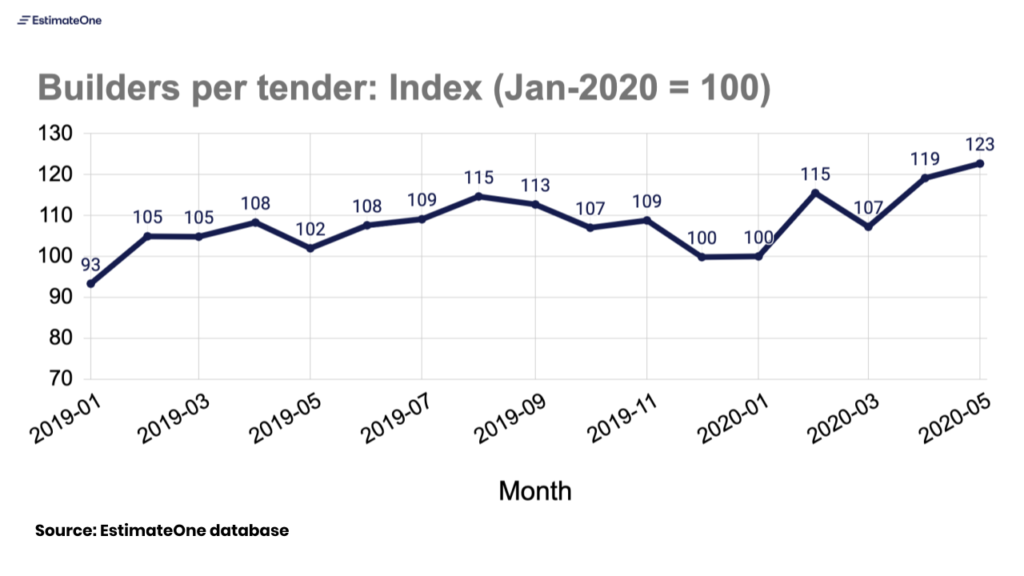

Commentary:

- Here we are seeing a clear uptick in builders per tender for tenders that closed/are closing in April and May.

- By industry, we are seeing an increase in competitiveness is most noticeable in Commercial, Education and Fitout tenders.

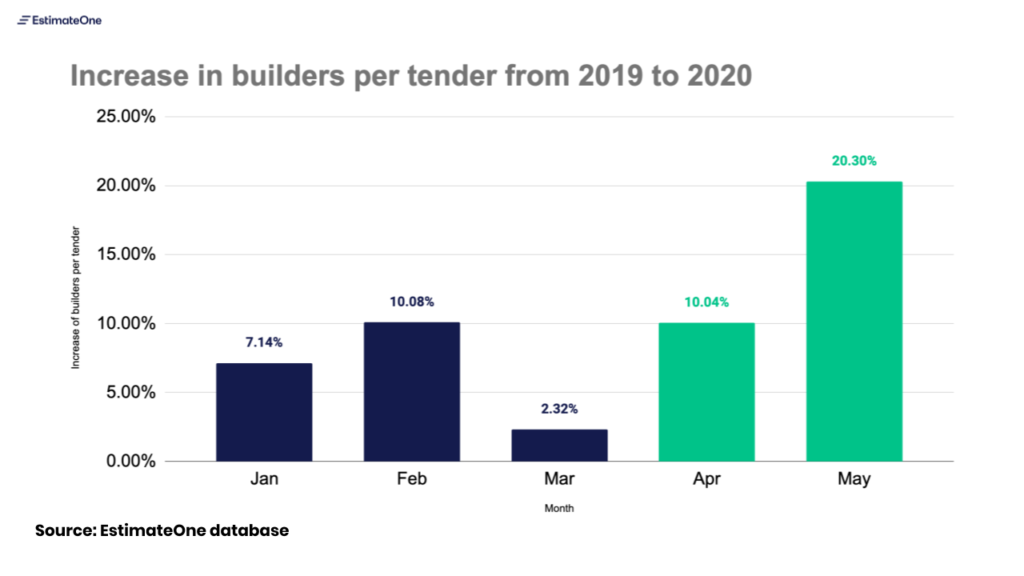

Commentary:

- By showing a year on year comparison, we can see that a decrease in tenders being added to the noticeboard has led to a more competitive than average May.

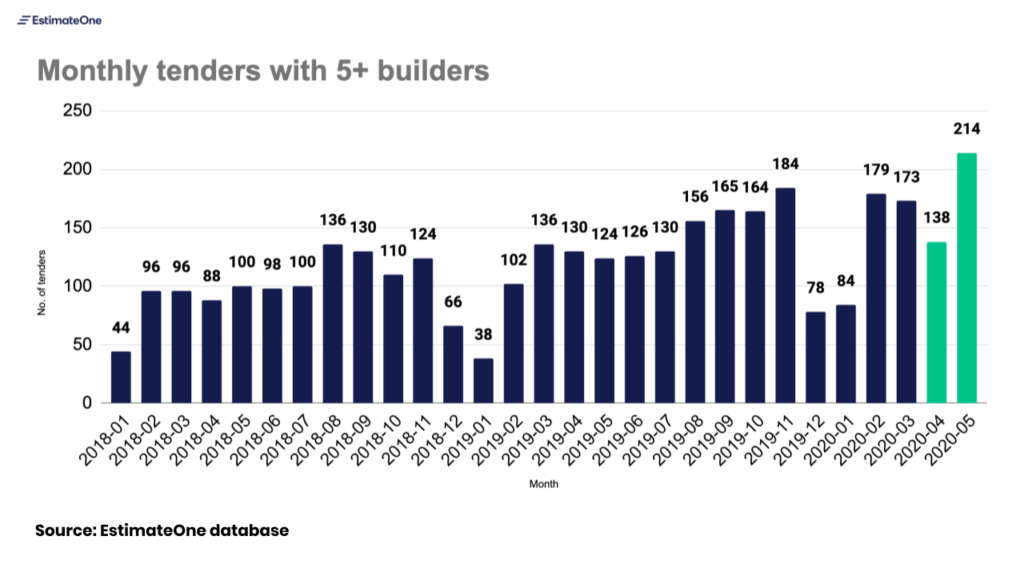

5+ builders per tender:

Commentary:

- Traditionally, we’d see spikes in projects with 5+ builders towards the end of the year.

- However, currently we are seeing a big spike which defies usual April/May activity.

- Anecdotally we have been told of a school project being tendered in Queensland that has in excess of 20 builders on the tenders panel.

What we’re hearing:

Tough times ahead for tier ones:

- We’re hearing that the pipeline of future works suitable for tier one builders is starting to dry up. These pipelines were slowing prior to COVID-19 and the uncertain economic outlook is only making it harder to get these projects off the ground.

- Action taken by the government to fast track certain projects hasn’t been as helpful as hoped. Even with hastened approvals, the inability to secure sales/tenancy commitments is making it challenging to obtain finance

- We’ve also heard that some large corporates will be looking to make working from home arrangements permanent for a couple of days per week. If adopted at scale, this practice could reduce demand for larger commercial buildings

Subcontractors pencils are getting sharper:

- One client has told us they’ve seen drop in subcontractor prices upwards of 20%. This suggests that subbies are also desperate to secure a future pipeline of work.

- We’re hearing of some “particularly sharp pencils” in quotes that are being received. The AFR (link) last week shared an article where the winning tender came in at almost 30% below another bid.

There is good news coming for some:

- On Monday, Victorian Premier Andrews announced a $2.7 billion stimulus for the construction industry. The lion’s share of this stimulus will be distributed on education and social housing projects. Builders who work in this space or are able to adapt to these types of projects have the potential to do quite well.

- Projects that come from the Victorian School Building Authority also have a tender panel limit of 4 builders. Theoretically this should see an even spread of builders who are able to take advantage of the government stimulus.

- Although it has yet to be announced, other states (link) have hinted in the past that stimulating construction is a key part of their economic recovery plan.

We’re intending to continue this newsletter as we have updated data. We don’t anticipate sending it more than once per week. If this is not helpful for you, you can unsubscribe by using the button below.

After nearly two months of escalating restrictions, Australia seems to be turning a corner. A new app to complement manual tracing efforts, relaxation of social gathering rules in some states, and an even ‘flatter’ curve have all contributed to a much more optimistic mood in Australia – if not elsewhere in the world.

Happily, our data reflect some of this optimism, though the impacts differ by state and by industry. After a slower fortnight that added the Easter long weekend to any COVID impacts, this last week shows a strong pickup to pre-COVID levels of new tenders.

It’s important to caution this result with some of the less optimistic reports we’re hearing, especially about slow-downs in demand at the planning and design stages. The forward view remains uncertain, but this most recent week’s uplift is a welcome start.

Below we share some more detailed observations to help you navigate the impacts to our industry.

What we’re seeing:

Section 1: Aggregate new tender volumes

Commentary:

- The overall volume of tenders has increased from 200 in the week of Easter Monday to 259 this last week – back at the level we were seeing before the first impacts of COVID were being felt

- At a category level, Government tenders contributed the most to this increase; there were 49 new tenders from government last week compared to 25 the week prior

- It’s difficult to disentangle the effects of Easter; two four-day weeks might have delayed some tenders going out (leading to a ‘catchup’ effect) in week 7 which makes us hesitant to attribute this to any specific changes in the effects of COVID, but we’ll continue to monitor week by week

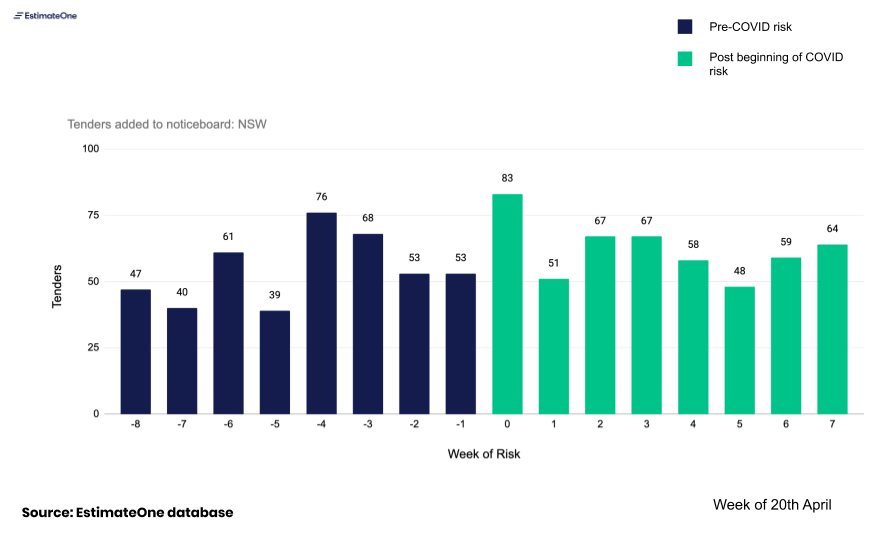

Section 2: State by state view

NSW:

Commentary:

- NSW has now seen 60 more tenders in the 8 weeks from the beginning of March than the 8 weeks prior (497 vs 437).

- Between them, Education and Government tenders represent an increase of 52 over the 8 weeks, offsetting falls in Aged Care, Civil and Fit Out tenders over the same period.

- Although builders we spoke to were seeing delays in tender awards and project go-ahead; (consistent with the awarded work data we shared in our previous newsletter), none were experiencing a slow down in new tenders nor had seen evidence of drop-offs in cost planning to date.

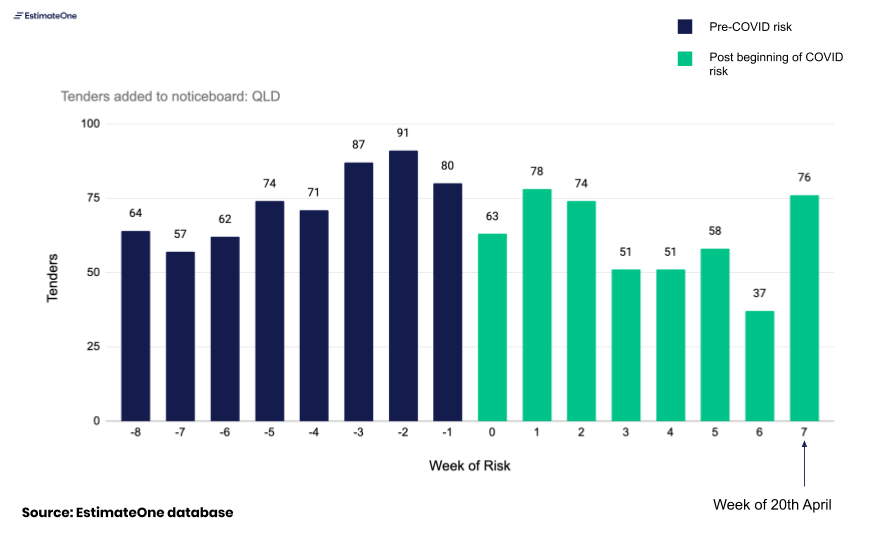

QLD:

Commentary:

- Queensland saw the most obvious ‘bounce’ of any state this last week, getting back to a weekly new tender level in line with the pre-COVID rate, having seen a steady drop-off since Week 0 of the COVID risk.

- This reflected the experience of builders we spoke to; the slow down had been felt but things were beginning to pick up again. Government tenders, in particular Defence and Medical were listed as the most likely to gain pace over the coming weeks, with an expectation that private tenders were more likely to be delayed where clients were in a position to do this.

- Although the increase in tenders happened across all budget ranges, the biggest increase was in the $10m + category (representing roughly a third of tenders in the state) which increased from 8 to 25 week on week.

VIC:

- Compared to NSW and especially Queensland Victorian tenders have shown a much steadier trajectory throughout the COVID risk period, although the composition of the state’s tenders has shifted by category. Commercial tenders, which represented roughly a third of tenders between weeks 0 and 3 have dipped since then to under a quarter, with the slack being picked up in part by a small increase in Government tenders.

- Builders we spoke to in VIC told us the state had felt ‘flat’ throughout, though wondered whether this reflected a slower start to 2020 more than any impacts of the COVID risk being felt more recently.

What we’re hearing:

- There is steady support for government funded projects, specifically in corrections, public housing and health. Builders we’ve spoken to have confirmed that this appears set to continue, with confirmations of tender lists for upcoming projects being announced during the last week for new projects.

- Assuming tenders take 3-6 months to prepare and bring to market, some builders are concerned about tenders that should be commencing preparation now, for arrival later in the year

- Both architects and quantity surveyors are reporting a dip in new enquiries for preliminary design and cost plan work, especially associated with new residential projects.

- There is growing concern from several builders around demand for high-density residential projects, especially that which would be classified as “investor stock” which will be more exposed to deteriorating rental market conditions and price expectations.

- Conversely, demand for medium-to-high-density residential projects catering to the owner-occupier market is holding steady.

Looking forward

With restrictions easing rather than tightening, we expect forward conditions for the industry to be impacted more by the demand outlook than by operating conditions.

On the upside, government projects are already representing a greater share of new tenders and we expect this support to continue, with state governments putting together stimulus packages that fast-track and expand already-planned projects. This support will be intended to offset downward pressures in other sectors. challenges to rental demand and projected falls in house prices are likely to threaten at least some sectors of residential demand, while recessionary pressures slow commercial and retail growth.

We’re intending to continue this newsletter as we have updated data. We don’t anticipate sending it more than once per week. If this is not helpful for you, you can unsubscribe by using the button below.

It’s hard to believe the pace with which COVID-19 has spread across the world, and the pace with which authorities and societies have reacted to it. From our vantage point at EstimateOne, although cases and restrictions in Australia have increased since our last newsletter, the initial panic seems to be subsiding.

Efforts across the country to ‘flatten the curve’ appear, for now, to be working. The rate of new cases identified is dropping and health systems remain able to handle the volume of patients presenting with the virus.

The Prime Minister has reaffirmed an intention between his office and the State Premiers’ to keep construction sites running, and this is reflected in continued activity across the industry. Tenders are still flowing, projects are still being awarded and construction sites are continuing to operate; although on all fronts we see the impact of COVID-19.

Below we share some more detailed observations to help you navigate the impacts to our industry.

What we’re seeing:

Section 1: Aggregate new tender volumes

Commentary:

- Tender volumes dropped from around 250 per week to around 220 in Week 3 of the crisis and this most recent week we saw a further drop to 198 – though a shorter week with Good Friday explains this further fall. We expect this coming week, also shorter, to show lower volumes too.

- We have confidence in attributing the March slow down to COVID-19. Last year weekly volumes in March were equal to February numbers, this year they’re ~10-15% down (see chart below)

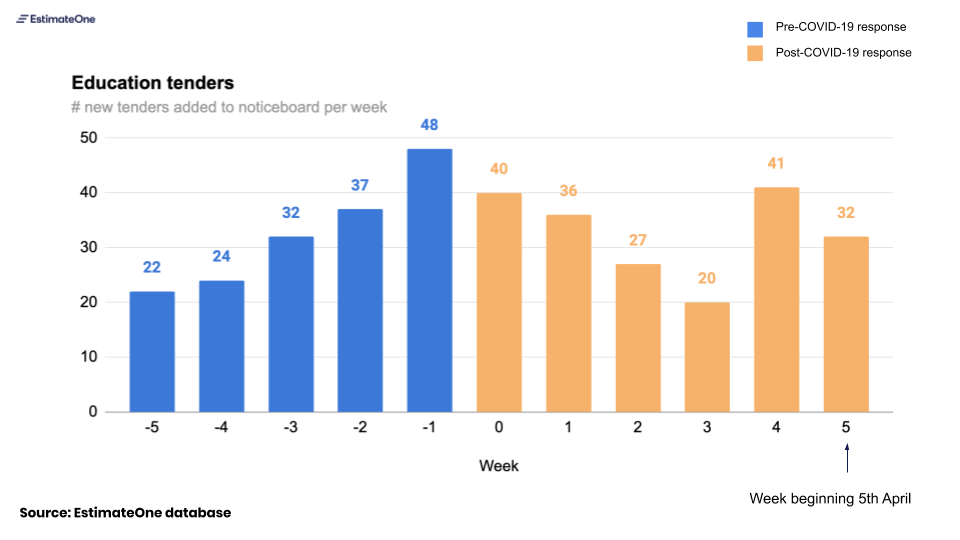

Section 2: Breakdown by sector

Education:

- In the first few weeks of March, education tenders halved from a high point in late February, but the last two weeks have seen an increase. Clients have mentioned education projects in Government pipelines being fast-tracked to tender as a COVID-19 response which may explain this uptick.

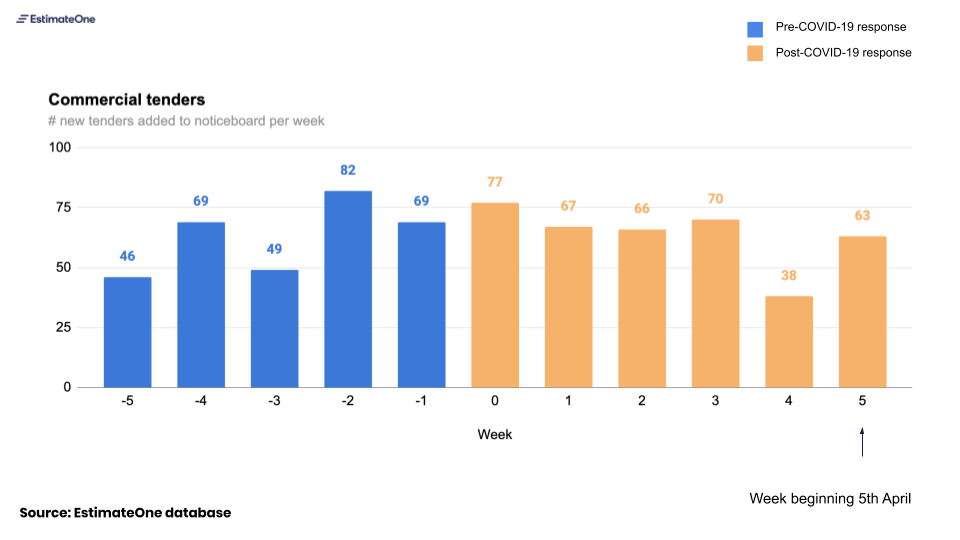

Commercial:

- Commercial had a more moderate drop-off which was concentrated in tenders above $2m (lower price tenders saw a reduction in the early weeks of the crisis but have since rebounded)

Fitout:

- We anticipated fit-out tenders to be amongst those most affected by the crisis and by the lock downs – but volumes remained higher until this last week where we saw a significant reduction. Our builder clients have suggested that their clients have been seeing opportunities to bring forward smaller projects given their empty offices – this is supported by our data; projects under $2m have actually increased since Week 0. (beginning of March)

Government:

- New government tenders have seen the most significant drop-off amongst sectors (note that this Category excludes tenders categorised to other sectors like Education or Medical which are likely to include Government clients). This drop-off is accounted for largely by a reduction in small tenders $0-$2m, with tender volumes $2m+ holding steady through February and March.

Residential:

- Residential tenders saw a similar volume profile to Government and Education – with a sharp drop in ‘Week 3’ and a recovery after that. Unlike Government, the reduction in Residential tender volumes has been most strongly in the higher-value tenders $2m+, with smaller projects less affected.

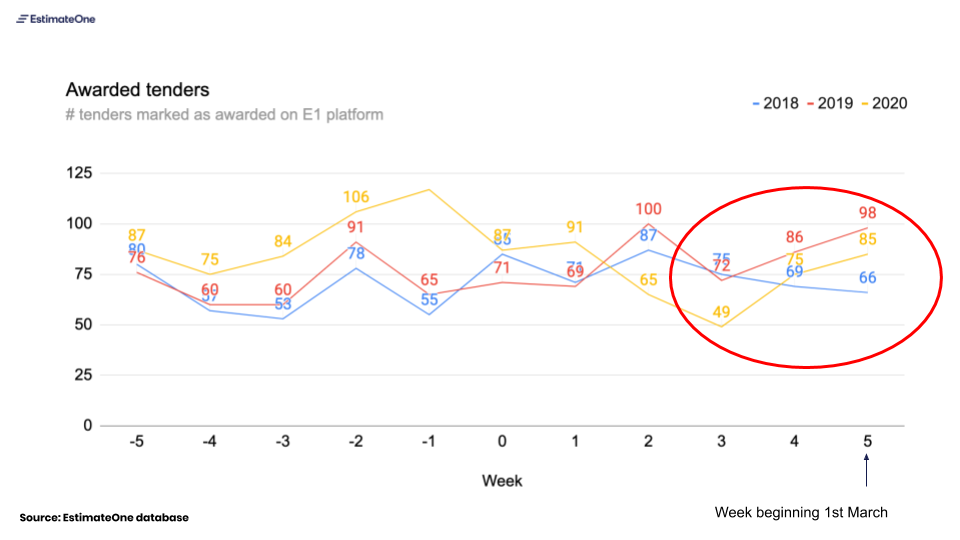

Section 3: Awarded tenders

Commentary

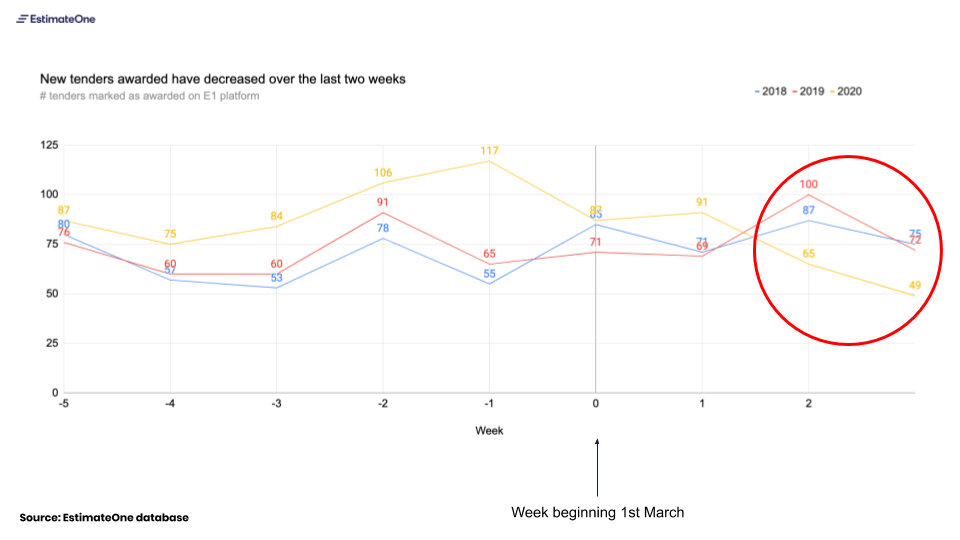

- Our last newsletter in Week 3 showed a drop-off in Projects awarded – a measure that regularly tracks between 70 and 100 at this time of year and which had dropped to 49 for the week. These last two weeks have seen a significant pickup in this measure. This supports what we’re hearing from Builder clients: decisions were delayed as the likely impacts of lock-downs for sites and projects were being assessed, and now that there is more certainty projects are continuing to move forward.

What we’re hearing:

- Builders have been quick in adopting new collaboration and remote working software to enable their teams to work from home – many of the builders we spoke to expect these new ways of working to remain in place even after the COVID-19 risk has passed.

- Although Government clients have shown an inclination to fast-track tenders where possible, this has not (yet) resulted in material volumes of new tenders to offset drop-offs in other categories.

- The ‘new’ rules and setups for hygiene and social distancing on site are being a norm, but are difficult to execute well (narrow corridors, lifts and doorways present challenges for distancing).

- Shut-down and clean protocols are well established and in use where COVID-19 cases are identified, with minimal disruption to the progress of a project. The impacts to productivity we’re hearing about are more linked to site-measures than to temporary shut-downs.

- Subbies, suppliers and builders have all spoken to greater optimism in the past fortnight than in the weeks before. The reality of lockdowns has been less dire than many feared, and the determination to keep sites running (despite the objections of some) seems resolute.

Looking forward

Our view two weeks ago was that stricter lockdowns, like those imposed in New Zealand, were coming. The flattening of the curve challenges this view. If case loads continue to drop, even as authorities work to increase health system capacity, governments may decide Stage 3 restrictions will suffice.

How long these restrictions will be in place depends on which exit strategy authorities select. Australia finds itself in a rare position globally to have a choice between seeking total elimination of the virus (with longer restrictions in the near term), and attempting a controlled infection rate that stabilises the health system (with lesser, but longer restrictions).

Beyond the duration of restrictions, additional uncertainties remain:

- Contractual interpretation of Covid impacts for clients, builders, subbies and suppliers remains uncertain for now. Force majeure, repudiation and frustration have all been mooted as protections for stakeholders. Lawyers we’ve spoken with during the week are optimistic that implied duty of good faith will prevail in dealings between parties during these challenging times.

- With slumping business confidence ([LINK]) and recession-level unemployment ( [LINK]) both looming, the economic outlook is gloomy, however the depth and duration of this impact for construction industry demain remains uncertain. This impact will depend strongly on the degree to which stimulus efforts focus on creating demand.

We will continue to monitor the impact of the virus and the policy response to it on tendering in our industry in the coming weeks and will share what we find.

Over the past few weeks we have been talking at EstimateOne about how we can support our industry while it grapples with the challenge of COVID-19.

In the interest of sharing information to help everyone make better decisions, here are some observations made from our own platform. With more than 400 active head contractors and more than 40,000 active subbies and suppliers using EstimateOne, we believe we are well placed to provide analysis to support the industry as we all try to understand what’s happening right now, and what we should do next.

What we’re seeing:

Chart 1: New tender volumes

Commentary:

- We compared the new tenders added to our notice board by builders from before the crisis to after. We treat March 1st as the ‘beginning’ of the crisis (the 29th of February marked the first significant policy response from the Federal government with the implementation of compulsory self-isolation for returnees from several other countries).

- For the first three weeks volumes tracked ‘BAU’. Last week was the first week we’ve seen a slow down in tenders with 218 tenders compared to an average of 260 in the week previous. Typically the middle of the week is busiest for new tenders, with between 40-60 added to the noticeboard each day; on Wednesday and Thursday this week we had only 22 and 27 respectively (though this picked up on Friday).

Chart 2: Awarded tenders

Commentary

- The number of projects awarded by week is often a ‘noisy’ number for us (it depends, amongst other things, on builders reporting their awards on the platform), but the reduction over the past two weeks supports what we’ve been hearing from our builders – that clients are deferring their award decisions where possible.

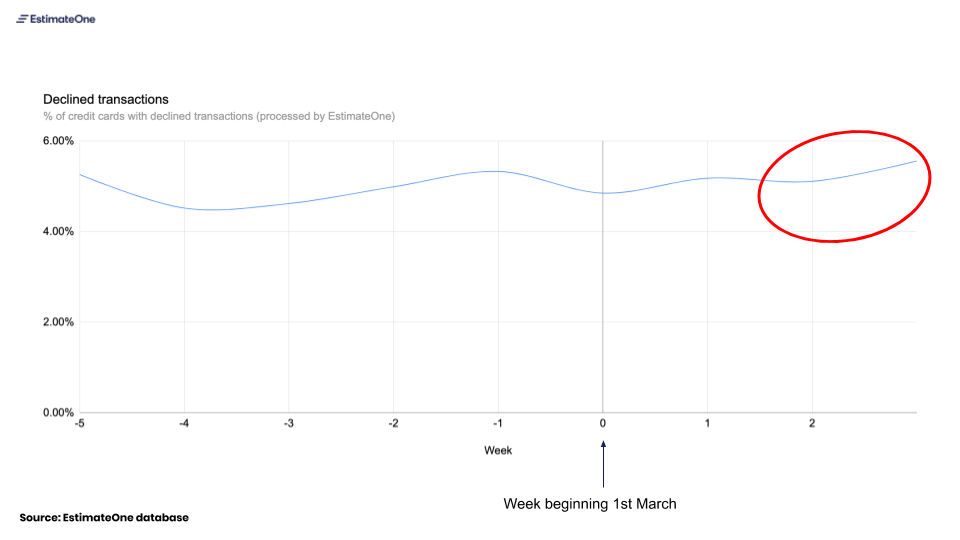

Chart 3: Subcontractor delinquency

Commentary:

- Cash flow for all parties in the industry is a concern through this period. One indicator we track is the decline rate for credit card transactions (for our noticeboard subscriptions). This rate has increased only slightly from its usual 5% to 5.6% over the past week.

What we’re hearing:

- As of the weekend there is still an intention to keep sites running for active projects. Construction sites are deemed ‘necessary activity’ under the national guidelines, and we haven’t heard (yet) of site shutdowns.

- Tendering is still active and volumes have been ‘normal’ throughout most of March (this corresponds with data shown above).

- Builders are adapting to social distancing rules quickly where this is possible: many have implemented blanket working-from home policies or are working with rotating in-office shifts (dividing the business into teams who rotate in and out of the office). On-site options are more challenging, but builders are implementing new practices for hygiene and distancing on site, creating more space for amenities. Staggered working hours are being considered on some sites.

- Early impacts of COVID-19 are being seen in Head Contractor awards: clients are deferring award decisions in the face of uncertainty in their own businesses and the economic environment (this is reflected in our data).

- Business Development activity has slowed right down, a combination of remote work plus a desire to defer decisions whilst the outlook remains uncertain.

- Departments of Health are paying additional funds to accelerate progress on live jobs, in particular those which yield additional ICU beds.

Our view of what’s coming

- It’s likely further lockdown restrictions will be put in place, especially if States decide to move on their own. Stage-3 restrictions in Victoria (as an example), adopted after the National Cabinet announcement on Sunday, still permit construction activity to continue, but Premier Andrews has signalled a willingness to move ahead of National guidelines.

- Rules for sites will become more, not less, restrictive in the near term. NZ-style restrictions are likely, where “essential” construction activity is that which is related to the building of essential services and/or human health.

- New fit-out tenders are likely to see a material drop-off as clients defer decisions on new office moves/refurbishments whilst their staff work remotely.

There will be concerted efforts to develop test kits for rapid detections of antibodies, allowing people who have developed an immunity to the virus back on site. UK researchers should announce material progress this week. Link

We’re intending to continue this newsletter as we have updated data. We don’t anticipate sending it more than once per week. If this is not helpful for you, you can unsubscribe by using the unsubscribe button below.

This is a difficult time for everyone. We all have a part to play in supporting each other and our industry through this challenge.

Our commitment is to continue to provide insights and observations as we see them over the coming months, in the hope that they may help you make the best decisions for your business. If you have questions you think we can help you answer – we’re here to help.

Our thoughts are with you, your organisations and your families.

Cheers,

Mike

Michael Ashcroft

Founder, EstimateOne

What does a Construction Estimator do and why?

There’s something pretty unique about the Estimator.

Crazy hours, not many quiet moments and having to work within razor thin margins — you sometimes wonder who these nutters are.

Let’s say we stepped into a room of construction students and asked them what they wanted to do when they graduate. My guess is the majority would be keen to be Project Managers. A couple would be keen to get into contract administration. No doubt more than a handful of the ambitious ones are already thinking about what to hang in their office when they become a General Manager.

You wouldn’t guess that many would say they wanted to be an Estimator — you probably wouldn’t even blame the grads for not knowing what an Estimator did.

That pretty sums up the Estimator — the surprise (but super rewarding) career in construction that no one knew they wanted to get into.

What is a construction estimator?

A construction estimator prepares the budget for building and construction projects. They are usually expected to:

- audit projects,

- prepare cost estimates, and

- manage overall building expenses.

The construction estimator is usually the one to negotiate the prices and quotes with any sub-contractors and suppliers on a construction project.

Construction Estimators go by many names

A construction estimator may also be known as:

- construction economist,

- building estimator

- quantity surveyor

- estimating manager, or

- cost engineer.

Construction Estimator For ABD Group – Jeremy Barrow

ABD Group’s Estimating Manager Jeremy Barrow wasn’t too different to most fresh construction students. When he was a uni he had aspirations of being a PM when he graduated. That was until he started his first role with Kane and was introduced to the Estimating department.

“I didn’t even know what Estimating was”, Jeremy told us — but it wasn’t long until he changed his tune.

The eureka moment was when Jeremy discovered that it was “a business within the business, which is in the business of winning”, and Jeremy liked to win.

Construction Estimating: All About Winning Business

It’s not a rare thing to find this competitive streak in an Estimator. After all, there is a rhythmic cadence to putting in a tender. It’s a bit like a season of footy — you know what you need to do, you know the opposition, yet every game (or tender) is completely different.

Jeremy describes it a bit like a university exam every three weeks, but a bit more fun.

“Every three weeks you have a new submission to put in, present to the client, get a bunch of subcontractors involved and work together with this team. In the end, if you are good, you get a win”

But it’s not all about winning at all costs. It’s about winning, and winning well.

Once the building has been built, the client needs to feel that they’ve got the best value, and a high quality finished product.

Construction margins are at an all time low. That means there is a big focus on every detail, and how each detail can be done more efficiently. The Estimating department is at the frontline of many of these cost v quality decisions. Helping navigate a minefield of labour, plant and material trade-offs.

And within all these tradeoffs and concessions, you still need to win the job.

At a strategic level, estimating is about looking at the project and finding the most clever way to build it. What can I find in this project that will get it over the line?

What’s the best way to work with the market out there? What’s the best way to work with the Project Managers and the 100 odd trades you need? What’s the best way to pull together a proposal that will convince the client and get this thing built, and built well?

It’s a lot to take on, and it all can’t be captured in a number. Estimating is just as much about having a holistic view to the project. As Jeremy pointed out to us, the winner isn’t judged solely on dollars — it’s won by those who can find the smartest way to build the thing.

“The pitch is just as good as the price… the dollars mean nothing unless you understand what’s behind the dollars.”

In the end, it’s about being that key cog in the bigger machine. Taking those architectural drawings and working out how we can turn it into something physical.

This is what the love of Estimating is all about. The concept of taking an idea, assembling the right team, and getting the ball rolling on turning that idea into a reality.

What is BIM?

Broadly speaking, ‘BIM’ (Building Information Modeling) encompasses a shift from documenting buildings and structures in 2D format as plans, sections and elevations, to documenting buildings in 3D format as physical forms, volumes and materials.

BIM has been a topic of hot conversation for some years now, but its adoption in Australia’s construction industry has been tepid. Broadly speaking, ‘BIM’ encompasses a shift from documenting buildings and structures in 2D format as plans, sections and elevations, to documenting buildings in 3D format as physical forms, volumes and materials. It promises a shiny, bright future — a single source of truth during design and construction, and even post-occupation. So why wouldn’t an industry with so much to gain be running towards this with gusto?

Who is using BIM in Australia?

As far a players in construction tech go, you don’t get much bigger than Autodesk. We tagged along to their Connect & Construct Summit last week to see where BIM — and other tech advancements in the industry are heading. We saw some pretty amazing stuff. What we didn’t see however, is many of the big new advances being widely adopted. Why is this? Is there some kind of industry-wide resistance or is something else going on?

The resounding takeaway from the sessions is that the technology is ready — it’s us mere mortals holding back.

How can BIM be used?

Part of the challenge in adopting something as big as BIM is that it’s difficult to dabble in. It really needs wholesale, company-wide adoption to get the most out of it — and that’s a bit scary. It can feel like letting go of everything familiar, and often all at once. With the relentless pace of the construction industry, that’s pretty daunting- there’s no chance for it to pause, adopt and improve.

Certainly for large industry players, this is most true. And it is not for lack of trying. It’s increasingly common for large general contracting businesses to be putting concerted efforts into the technology systems as a source of competitive advantage. Hansen Yunken’s HYWAY initiative is a great example of this, there are many more.

Investing in construction technology

But maybe BIM isn’t the best place to start, it’s certainly not the only place to start. At the Connect & Construct Summit, we heard that in the last 12 months alone, there’s been over $1b in capital invested in construction technology startups, globally. Beyond BIM, we’re spoilt for choice. But looking at ‘technology’ can a bit like drinking from the fire hydrant — it’s too much all at once. The path of least resistance lies in not looking at the technology at all — or at least not as the starting point.

The key will be starting small, and starting with a business problem. Rather than being overwhelmed by the ‘big’ wins, have a crack at the ‘quick’ wins.

Going paperless with BIM

Matthew Bien-Izowski (Managing Director, BN Electrical Contractors) talked through his success with such a quick win. In 2018, they set a goal to be paperless everywhere by 2019. Ambitious, and yet tangible. Far from saving trees, it seems this was about wanting to have the most current information for everyone, all the time, everywhere.

While eliminating paper doesn’t sound groundbreaking, it is measurable, trackable and valuable. With their goal in mind, BN Electrical looked to what technology would get them there. They realised that their $20k annual spend on printing could be better spent on 40 iPads. They found a tech tool that suited, and got to it. Fast. And they reaped rewards equally quickly, quoting a 12% cost reduction and zero rework on a recent Melbourne-based project.

And perhaps herein lies the solution to these tech adoption challenges — the frontrunners will be those that can find the quick wins. Shifting from a 5 year horizon, what can get done in 12 months? Or even 3 months? Rather than the big industry players going first, perhaps smaller businesses are better placed to lead the way, able to adopt new ways of working in one sweep. That’s a pretty liberating concept.

What will make a difference to your business?

What will make a difference to your business? It might be reducing paper, but it may equally be about reducing the number of internal emails. Or reducing the amount of re-work based on working from outdated documentation on site. Perhaps it’s safety related, or even invoicing. No problem is too small to start, but knowing what you’re trying to improve means you’re in the driver’s seat. You’re the one putting the tech to work, rather than trying to figure out how the tech works.

The game is changing, and BIM is definitely part of this world, but to get there we probably need a bit of a rolling start. And it seems the best way to do that is to actually look away from the light, rather than stare into the sun.

Whether you’re a builder (building contractor) or a tradesman, at some point or another, you’re going to need to subcontract work so you can continue yours.

Hiring the right subcontractors, and having an effective and efficient stable of subcontractors to have on your side, can be the difference between a successful project with a healthy profit margin, and declaring bankruptcy on a failed train-wreck.

Your subcontractors are a direct representation of your company, and it pays dividends to build your team wisely.

Building a strong subcontracting army is a simple four-step process;

- Finding your subcontractors

- Getting a quote

- Vetting the trade

- Contract negotiations

Let’s begin!

Finding the right subcontractors

The traditional method of finding subcontractors still works today. Asking friends who have completed similar projects, browsing the Yellow Pages, a basic internet search, and plenty of cold calling will all produce results. But it’s a slow way of doing things.

Construction is one of those industries that seems to be resistant to the technological stampede that is crashing through society. We’re a stubborn bunch, and we’re more at home with a power saw or nail gun in our hands than a mobile phone or computer.

Most builders already have extra long lists of subcontractors built up over the years. With an estimator’s workload full enough as is, they often revert to the “tried and true” subbies. Finding the next up and coming subcontractor who could help save a builder a lot of time and money can be tough, yet fruitful for everyone involved. After all, it makes sense to continue to look for subbies you haven’t used before.

Estimate One makes finding subcontractors easy

Fortunately, EstimateOne is here to connect subcontractors and builders in an easy to use system. Listing a project on our noticeboard will let all registered subcontractors view and download your documents. You can observe who’s seen them and know who to chase up.

Would you rather spend hours searching the internet or cold calling phone books, then printing documents out, and posting them by hand? I didn’t think so!

(*hint hint nudge nudge* — go make a free account here, I’ll wait!)

Getting a quote

Once you’ve found a stable of subcontractors, you need to request a quote to compare them all.

If you feel like being lazy, the easiest path is to leave them to it and what comes back is what you get. You will leave yourself at the subcontractor’s mercy and hope that everything is quoted. If you get pricing at all, that is!

Let’s say you want to build up a strong database of subcontractors who you know and trust. Then you first need to show them that you are worth knowing and working with. The best way to do this is to complete half their quoting for them. Enter the “scope of works” document.

Scope Of Works Document

Creating a scope of works document clearly outlining what you need to be priced for a project goes a long way to proving your capabilities as an estimator or project manager. You’re giving the subcontractor something to reference as they review the documents and specifications, and if they are not able to price something on your list, they can mark it as such instead of saying “mate, I just didn’t price it.”

As a former estimator who worked for a commercial builder, I speak from experience when I say that very little in this industry is more frustrating than receiving five quotes and not a single one is comparable. If you spent the 30 minutes to give your team direction at the start, you could save yourself hours at the end plugging the quotes full of holes.

Creating a complete, detailed scope of works document will be the topic of another blog post.

Vetting the trade – Comparing subcontractor quotes

Before you hire a subcontractor, it’s essential at this stage that you understand what each subbie has allowed for. There’s no one “correct” way to get this done. Some builders use software like Buildsoft, CostX, or Expert Estimator to fill in information and start ticking boxes. Others use custom Excel sheets. Provided you have a way to compare quotes apples-to-apples, you’re ready to start your vetting.

So you did your scope of works document, your subcontractors are singing your praise, and hopefully you now have three or four comparable quotes to review. This is the comfortable place us estimators refer to as “nirvana.” The estimating manager gets to leave his butt-kicking boots in the cupboard for the day.

If you’re using EstimateOne, your subbies should have read our subcontractor quoting guide. The quote would list inclusions, exclusions, clarifications, and any other information they deem relevant that you may have missed. Again, you need to be in a position to compare apples to apples. We don’t have time for oranges in this mix.

Rule one of Estimating Club — never go off price alone. If you have three prices at $100k, and one at $30k, do NOT for the love of building pick the $30k subcontractor yet. Something is off. Either three subbies are in cahoots or someone got left behind.

When everything is noted down and compared, you may find that the $30k price you received excluded supply of everything, or only allowed for a partial scope of works. And maybe the $100k subbies have allowed for items which are marked as provided by the client and their price comes down. Sometimes you may even find that by combining subbie quotes you wind up with a better price altogether. (Side note; double check with the subcontractor before doing this. Their price may change if you start pulling things off their quote!)

By now you should have three or four prices that are fully vetted and ready to withstand the bashing that managers like throwing your way. You have covered all the risk associated with the subcontractor, adding or subtracting cost where appropriate. You might even find you can play them against each other to bring the price down further.

It’s important to note at this point that price is just ONE aspect of many to picking the right subcontractor. You need to know they have the people and skills required for the job, the financial backing, the insurances, the attitude, etc. The sharpest price can be shot to flames in contract negotiations …

Contract negotiations – The subcontractor contract

Let’s recap.

You’ve found some tradies, you’ve issued them a scope of works, they’ve sent their quotes across, you’ve compared them apples-to-apples, and now you’ve picked the one or two best of the bunch.

There are a few more things to do before anyone is told they have the job.

Reference checks

If you go to the bank and withdraw one million dollars, would you feel confident giving it to a stranger who says the right things? This is the same as handing a contract to a subbie you haven’t reference checked.

Subbies who’ve been in the industry a while will have a few project managers who can vouch for their work. If they haven’t included them in their quote, let them know you’re interested in their quote but you need to do some due diligence. Call the project managers and query them on the subbies work ethic, punctuality, time management, quality of work, and how they handled variations and defects.

These last two are critical to understanding what happens when the subbie is under stress and needs to fix issues with their work. If the subbie is always on time, ahead of schedule, and under cost, but is tardy at repairing defects and constantly charges variations, then you run the risk of cost and time blowouts in rectification works.

Sometimes your preferred subcontractor is a new tradie which doesn’t have much experience. This can be risky, but at the same, you could also be assisting an absolute superstar grow their own business. If their company is new, ask for previous employer references so you can verify the details as above.

Add all the reference notes to the trade vetting for further comparison.

To learn more about common contract types, read our guide on construction contract types in Australia

Steering the same ship

Once you’ve verified the subcontractor’s abilities and settled on the contract to be used, it’s time to ensure you’re both steering the same ship.

Understand the intricacies of the contract you’re using and make sure that you both agree to the terms and conditions you’re signing. Make sure the payment terms match those of the client, so the money flows downstream properly. Make sure the defect liability period is suitable. Make sure the quality details in the contract are at a level you’re both comfortable with.

Spending extra time on the contract review up front could again save significant time and money down the line should an issue arise. As far as the law is concerned; it’s not what you know, it’s what you can prove!

Get building

Congratulations, you’ve now got a subcontractor from a pool of many who has passed all your tests. Now your risk is reduced, you can get on with the job of building.

To recap;

Get a good number of subbies to price your project.

Make the subbies job as easy as possible to quote, including giving them a scope of works document.

Vet the trade. Compare them all apples-to-apples, and leave no stone unturned on their quotes. Understand everything allowed for and/or excluded.

Pick the right contract for the job and ensure you both agree to all the terms. You’re there to work TOGETHER, not at each other’s throats.

Profit together!