After nearly two months of escalating restrictions, Australia seems to be turning a corner. A new app to complement manual tracing efforts, relaxation of social gathering rules in some states, and an even ‘flatter’ curve have all contributed to a much more optimistic mood in Australia – if not elsewhere in the world.

Happily, our data reflect some of this optimism, though the impacts differ by state and by industry. After a slower fortnight that added the Easter long weekend to any COVID impacts, this last week shows a strong pickup to pre-COVID levels of new tenders.

It’s important to caution this result with some of the less optimistic reports we’re hearing, especially about slow-downs in demand at the planning and design stages. The forward view remains uncertain, but this most recent week’s uplift is a welcome start.

Below we share some more detailed observations to help you navigate the impacts to our industry.

What we’re seeing:

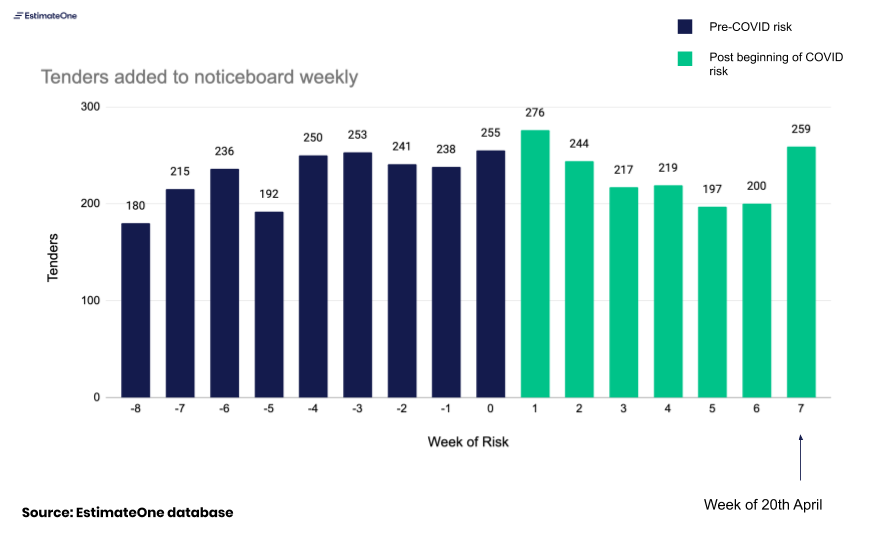

Section 1: Aggregate new tender volumes

Commentary:

- The overall volume of tenders has increased from 200 in the week of Easter Monday to 259 this last week – back at the level we were seeing before the first impacts of COVID were being felt

- At a category level, Government tenders contributed the most to this increase; there were 49 new tenders from government last week compared to 25 the week prior

- It’s difficult to disentangle the effects of Easter; two four-day weeks might have delayed some tenders going out (leading to a ‘catchup’ effect) in week 7 which makes us hesitant to attribute this to any specific changes in the effects of COVID, but we’ll continue to monitor week by week

Section 2: State by state view

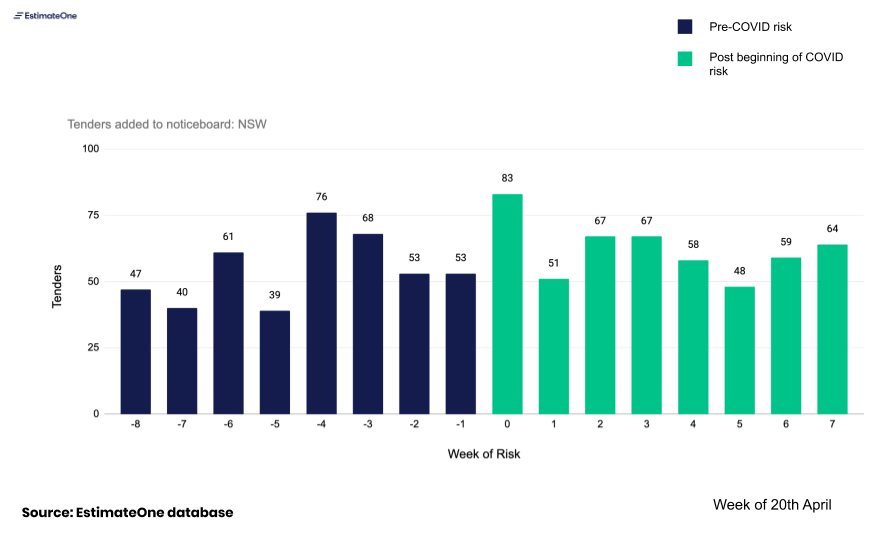

NSW:

Commentary:

- NSW has now seen 60 more tenders in the 8 weeks from the beginning of March than the 8 weeks prior (497 vs 437).

- Between them, Education and Government tenders represent an increase of 52 over the 8 weeks, offsetting falls in Aged Care, Civil and Fit Out tenders over the same period.

- Although builders we spoke to were seeing delays in tender awards and project go-ahead; (consistent with the awarded work data we shared in our previous newsletter), none were experiencing a slow down in new tenders nor had seen evidence of drop-offs in cost planning to date.

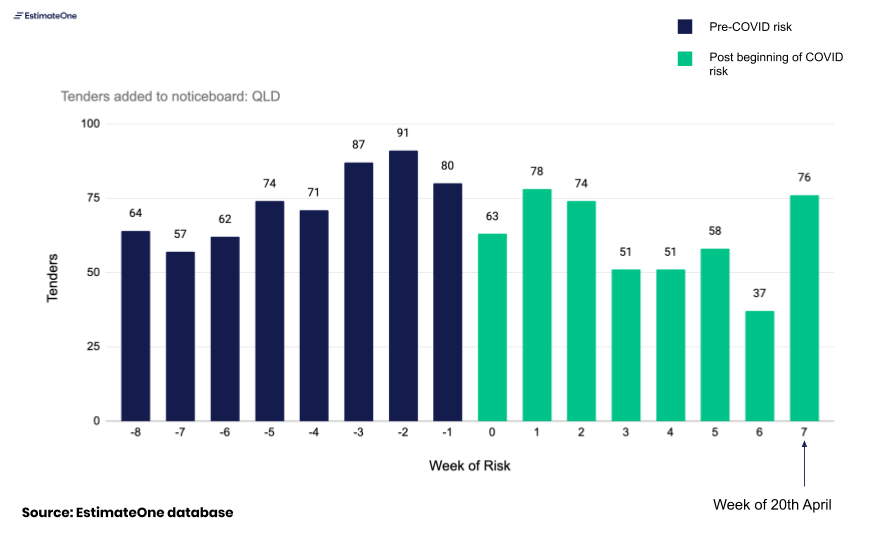

QLD:

Commentary:

- Queensland saw the most obvious ‘bounce’ of any state this last week, getting back to a weekly new tender level in line with the pre-COVID rate, having seen a steady drop-off since Week 0 of the COVID risk.

- This reflected the experience of builders we spoke to; the slow down had been felt but things were beginning to pick up again. Government tenders, in particular Defence and Medical were listed as the most likely to gain pace over the coming weeks, with an expectation that private tenders were more likely to be delayed where clients were in a position to do this.

- Although the increase in tenders happened across all budget ranges, the biggest increase was in the $10m + category (representing roughly a third of tenders in the state) which increased from 8 to 25 week on week.

VIC:

- Compared to NSW and especially Queensland Victorian tenders have shown a much steadier trajectory throughout the COVID risk period, although the composition of the state’s tenders has shifted by category. Commercial tenders, which represented roughly a third of tenders between weeks 0 and 3 have dipped since then to under a quarter, with the slack being picked up in part by a small increase in Government tenders.

- Builders we spoke to in VIC told us the state had felt ‘flat’ throughout, though wondered whether this reflected a slower start to 2020 more than any impacts of the COVID risk being felt more recently.

What we’re hearing:

- There is steady support for government funded projects, specifically in corrections, public housing and health. Builders we’ve spoken to have confirmed that this appears set to continue, with confirmations of tender lists for upcoming projects being announced during the last week for new projects.

- Assuming tenders take 3-6 months to prepare and bring to market, some builders are concerned about tenders that should be commencing preparation now, for arrival later in the year

- Both architects and quantity surveyors are reporting a dip in new enquiries for preliminary design and cost plan work, especially associated with new residential projects.

- There is growing concern from several builders around demand for high-density residential projects, especially that which would be classified as “investor stock” which will be more exposed to deteriorating rental market conditions and price expectations.

- Conversely, demand for medium-to-high-density residential projects catering to the owner-occupier market is holding steady.

Looking forward

With restrictions easing rather than tightening, we expect forward conditions for the industry to be impacted more by the demand outlook than by operating conditions.

On the upside, government projects are already representing a greater share of new tenders and we expect this support to continue, with state governments putting together stimulus packages that fast-track and expand already-planned projects. This support will be intended to offset downward pressures in other sectors. challenges to rental demand and projected falls in house prices are likely to threaten at least some sectors of residential demand, while recessionary pressures slow commercial and retail growth.

We’re intending to continue this newsletter as we have updated data. We don’t anticipate sending it more than once per week. If this is not helpful for you, you can unsubscribe by using the button below.