Lead with data to make a fast start in 2023

With the end of the year fast approaching, many of us are undergoing strategy and budget planning initiatives for 2023. But, when it comes to assessing historical sales data and market trends, this can often be an arduous process, with limited access to the right information (especially on your competitors!).

This year at EstimateOne, we’ve made a big push to bring more of our rich industry data into the platform. By providing a 360 degree view of your business across the market for your sales and marketing teams, to better analyse past performance, identify emerging trends to help shape your business’ strategy and gain a unique competitive advantage.

Our new specification & market insights product aggregates the latest specification trends of the brands and products across Australia, by state, by construction category, and most importantly, by the consultant responsible for these specifications.

As Australia’s largest database of specification data, our platform combs through our public tender noticeboard, collecting on average 12,000+ projects with an estimated construction value of over $80b annually. That’s a whole lot of data!

On-demand insights are then made accessible to your business within the EstimateOne platform via a suite of easy-to-interpret visual insights, enabling your organisation to:

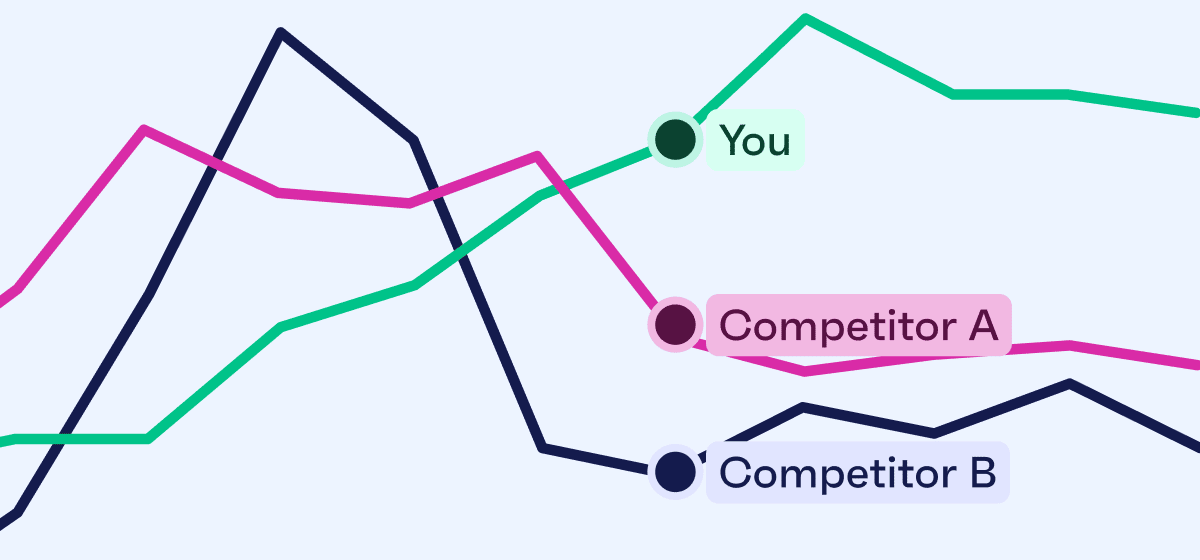

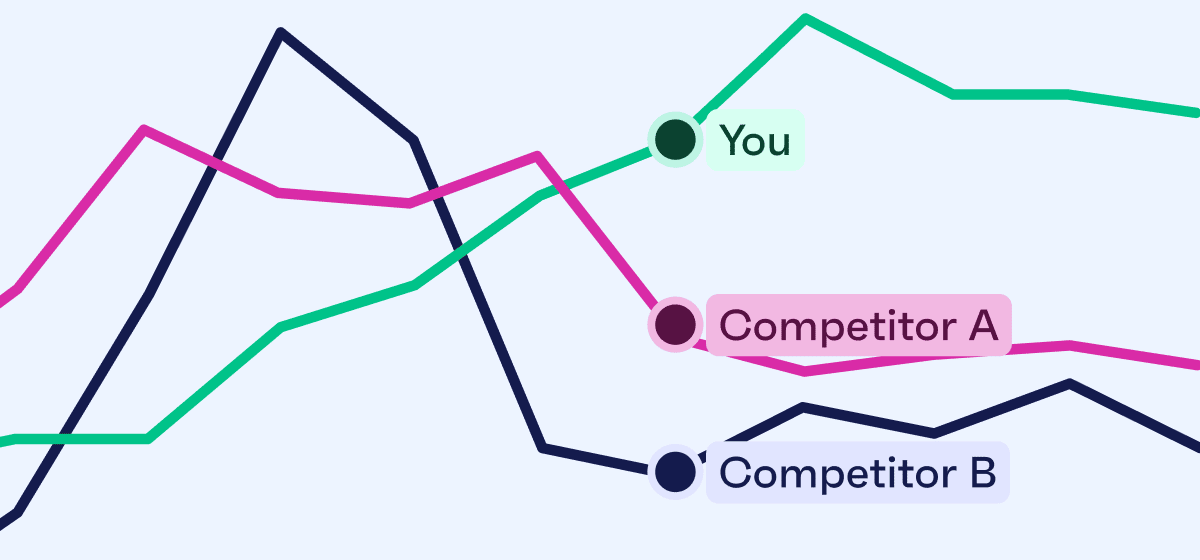

> better understand your position in the market relative to your competitors

> discover specification trends

> identify high growth opportunities

> access key consultants responsible for these specifications

> manage your sales forecasting on key construction stage projects (scheduled to commence over the next 6-12 months)

In this article, we explore three ways specification and market Insights can help support your business with sales budgets and strategy for the year to come.

Using EstimateOne’s specification insights, you can quickly gauge a view of the percentage of times you and your competitors’ brands were specified in the market. This can be assessed at a national, state and category level.

When assessing your market share, look for opportunities to grow your brand. For instance, if you have a 75% market share in your home state, you may prioritise resourcing in other states where your market share isn’t as strong.

For others, the underlying growth strategy is simply to know how many projects are in the market that specify their products and hold onto these specifications. For instance, most clients we speak with believe that around 20% of the projects that specify their products or brand could be flipped by competitors.

They tell us that if their staff aren’t engaged with tracking and guiding projects, there is a higher chance of their products being flipped out. Thus, they create a simple defensive strategy – to hold projects that have their specification. This alone can result in a significant increase in sales revenue, by reducing sales leakage and converting more upstream specifications into sales.

The construction industry is full of peaks and troughs. For instance, Tarric Booker of News.com.au writes, “dwelling approvals have fallen 29% as of the latest data for June this year”. At face value, this sounds like a grim outlook for the near future of residential construction. The compounding impact of fewer projects in the market with the same number of suppliers on these projects then creates a highly competitive market, where more players are quoting on a smaller number of projects.

With that said, EstimateOne market insights analysis demonstrates over the past 12 months; there has been a 13% increase in the volume and a 53% increase in the valueof projects in the Education sector across the nation. Some states see upwards of a 30% increase in the volume of education projects! Using these insights, Suppliers can pivot their business to focusing on the project sectors seeing the strongest need for their products and services.

Of the 4,400+ architects recorded over the last three years across EstimateOne projects, the top 20 percentile was responsible for 63% of all projects. This demonstrates that your team shouldn’t be expected to engage and influence 4,400 architects to gain specifications. Just focusing on the 880 architects winning all the work would yield the strongest result for your business.

Our consultant insights can help your team understand who the architects are that are winning work and, most importantly, the brands and products they’re specifying. If you’re investing in bringing new resources into your team, our consultant insights can help point these new recruits towards the architect’s winning work in the market or architects working in key growth sectors, giving you a better chance of influencing future specifications.

A complimentary defensive strategy is to understand the architects also specifying your brands, and ensure you’re developing strategies to retain and enrich these relationships.

The construction industry has seen a decade of unprecedented growth. Suppliers have had a fortunate seller’s position in the market where having staff and stock at hand to process orders has been the biggest concern.

As the market begins to slow, now more than ever, it is important to develop a holistic game plan for the new year to grow sales through calculated, data-driven strategies.

If you’re interested in leveraging data and insights for a fast start to growing your business in 2023 – schedule a demo today to learn more about our data and insights capabilities by giving us a buzz on 1300 705 035 or email support@estimateone.com