The Australian commercial construction sector isn’t just ticking along — it’s shifting under our feet. If you’re a building product supplier, you’re operating in a market that’s becoming more selective, more competitive, and more opportunity-rich for those who know where to look. This report leverages proprietary E1 data to show you where to invest your resources for maximum gains in 2025 and beyond.

On the E1 platform, tender activity held steady over the past year — a low single-digit change overall — but that stability hides sharp differences between sectors. Education and healthcare are booming with double-digit tender growth, industrial projects are charging ahead (especially logistics and data centres), while retail and private commercial builds have slowed or pivoted toward upgrades.

And competition? Fiercer than ever. With around 20 subcontractors bidding for every builder’s tender, the fight for a place on the winning team is intense. Labour shortages and rising costs mean builders are choosy about who they work with.

This report gives you the inside track — drawn from real, builder-sourced tender data covering a huge share of Australia’s commercial projects. We’ll break down where the growth is, what’s trending in specifications, and how to position your products for maximum pull-through.

Jump to section:

Where the work is, sector by sector:

Where the work is, sector by sector

Education – the standout performer

Education construction has been a standout performer in the past 12 months. E1’s tender data show a significant uptick in school and tertiary project tenders – roughly 15–20% more education projects year-on-year (simulated). This surge is underpinned by robust public investment. For example, the New South Wales government alone plans to release approximately $2.4 billion worth of school construction tenders in FY2024-25[1], with 100+ school project tenders already issued this financial year[5]. Other states echo this trend: Victoria and Queensland have also advanced new school builds and campus upgrades to accommodate population growth.

Education projects range from brand-new schools in fast-growing suburbs to significant upgrades of aging facilities. Many tenders now bundle multiple school projects together to expedite delivery (e.g. packages of preschools and primary schools tendered simultaneously[6]), signalling larger contracts and opportunities for suppliers able to service broad requirements.

Common works include classroom block construction, new gymnasiums and STEM centres, and modernising classrooms with the latest technology and furniture. Notably, specific product demands in this sector are shifting – tenders frequently call for items like advanced audiovisual systems, energy-efficient HVAC for classrooms, durable modular buildings, and security systems befitting contemporary campuses.

Sector Outlook: Education construction is expected to remain strong into 2025. Public funding for schools (e.g. programs to build 100 new preschools in NSW[8]) and universities (research facilities, student housing) continues, partly insulated from residential market fluctuations. Suppliers targeting this sector should emphasise proven experience in education projects and readiness to meet standardised design specs (like modular classroom designs from pattern books).

The takeaway: schools are “hot” – align your sales strategy accordingly.

Get an E1 supplier Pro Plus account today and access exclusive data straight from builders and architects

The education sector has been a real cornerstone of the commercial pipeline, with tender volumes nearly doubling in some regions. We see sustained government commitment – for instance, NSW’s record investment in preschools is the largest in state history, which creates a reliable flow of projects. Suppliers of classroom fit-outs, building materials, and educational equipment should be prioritising this sector.

Head of Supplier, E1

Healthcare – steady, big ticket growth

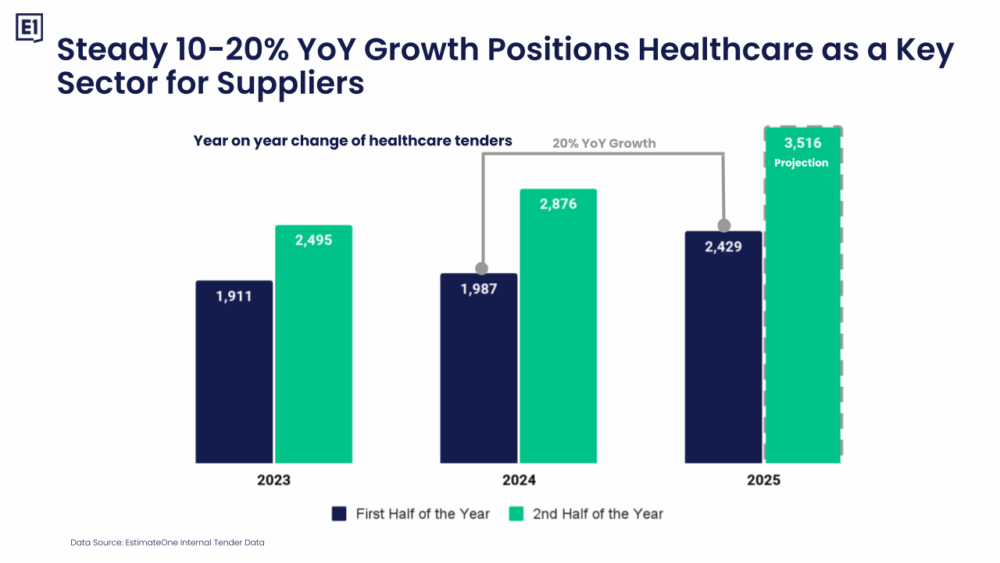

The Healthcare sector is another major driver of commercial construction, with a focus on hospitals, clinics, and aged care facilities. Tender activity in healthcare has been solid and growing at a steady pace (approximately 10% year-on-year, based on simulated data). Large capital works are prominent – for instance, Queensland’s ambitious Hospital Expansion Program (part of a $9.8 billion “Hospital Rescue Plan”) aims to deliver over 2,600 new hospital beds by 2028[9], including new hospitals and expansions across the state. Similar healthcare infrastructure initiatives are underway nation-wide as governments address aging populations and pandemic-driven capacity shortfalls.

Projects in this sector tend to be complex and high-value: new tertiary hospitals, specialised cancer centres, mental health facilities, and regional hospital upgrades. Major contractors like Lendlease, Multiplex, and John Holland have been active in bidding for these big-ticket projects, often in public-private partnership models.

From the supplier perspective, healthcare projects drive demand for a range of products – medical-grade HVAC and filtration, backup power systems, advanced security and nurse-call systems, specialty medical equipment installations, and high-spec finishes that meet strict health regulations (e.g. antimicrobial surfaces).

However, the healthcare building boom is not without challenges. Rising construction costs and budget pressures have started to bite: an independent review in Queensland revealed that the initial hospital program cost estimate ballooned from $9.8B to $17 billion, forcing a pause or re-scope of 15 planned projects[2].

This highlights a risk for suppliers – some hospital projects may face delays or scope reductions if funding gaps emerge. Nonetheless, the overall trajectory remains upward. Governments at both state and federal levels continue to prioritise healthcare infrastructure, and private healthcare providers are also investing (e.g. new private hospitals and aged-care developments).

Sector Outlook: Expect healthcare construction to maintain momentum. The pipeline for hospitals and aged-care is supported by long-term demographic trends (aging population) and political imperatives (improving healthcare access). Some controversy (and opportunity) arises from the constraints: capacity issues and contractor shortages have even led to innovative delivery models, and some builders self-performing more work due to subcontractor scarcity[10]. Suppliers should be prepared to accommodate fast-tracked schedules or phased project delivery, and ensure reliability – hospital projects can’t afford delays. Overall, healthcare remains a key market for suppliers in medical equipment, building services (MEP), and high-grade materials.

Major health projects are moving ahead, but under intense cost scrutiny. For suppliers, this means opportunities are there – hospital projects need vast quantities of specialised fittings – but you must demonstrate value. Those who can help builders meet tight budgets or timelines (through cost-saving products or prefabricated solutions) will have an edge in this sector.

Senior Data Analyst, E1

Industrial and logistics – robust and evolving

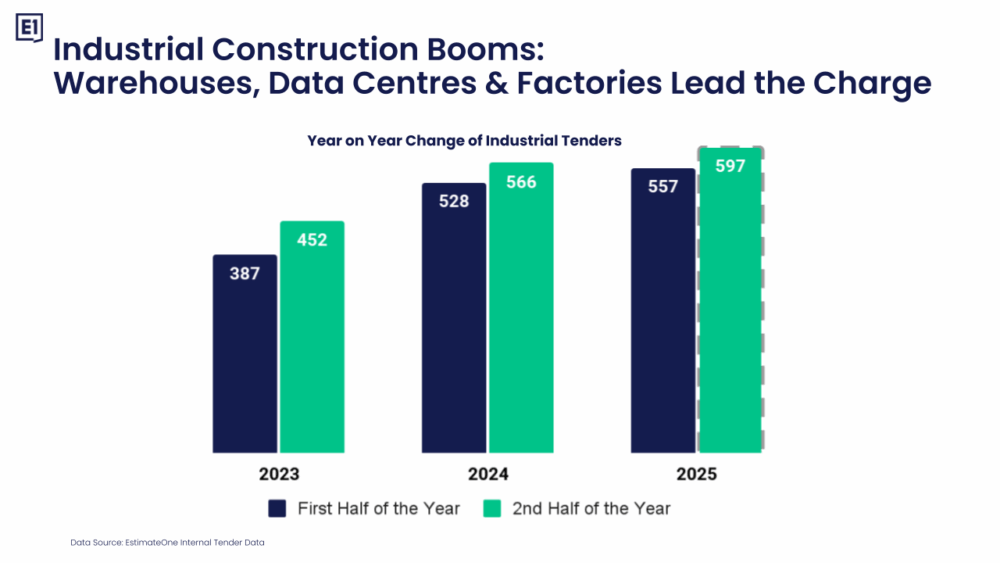

Industrial construction (encompassing logistics facilities, warehouses, factories, and data centres) has shown robust growth as a segment of commercial construction. In the past year, E1 (EstimateOne) data indicates industrial project tenders increased markedly (potentially 20%+ YOY, simulated), though with some quarter-to-quarter volatility. Several factors are driving this strength:

- Logistics & Warehousing Boom: The e-commerce and supply chain realignment of recent years continues to spur construction of large distribution centres and warehouses across Australia. Developers and REITs have invested in new logistics parks, especially in outer metro areas of Sydney, Melbourne, and Brisbane. These tenders typically involve massive steel sheds, advanced racking systems, and significant ancillary works (truck access, cold storage fitouts, etc.), translating to steady demand for steel building systems, cladding, loading dock equipment, refrigeration units, and more.

- Manufacturing & Industrial Facilities: Government efforts to boost domestic manufacturing (for example, in sectors like defense, pharmaceuticals, and renewables) have led to projects like assembly plants and industrial estates. Regional areas (e.g. in Queensland, South Australia) have seen new factories and food processing facilities tendered. While not a bulk of the volume, these projects are critical for certain suppliers (machinery, industrial flooring, specialty piping, etc.).

- Data Centres – a growing niche: Perhaps the most noteworthy shift is the pivot towards data centre projects within commercial construction. Developers who traditionally built offices or retail are increasingly pursuing data centre developments amid soaring demand for digital infrastructure[11]. Australia’s data centre pipeline has expanded (especially in Sydney and Melbourne regions), with tenders for new multi-megawatt facilities. These projects have unique needs – high-capacity electrical gear, backup generators, cooling systems – creating opportunities for electrical and mechanical suppliers. However, they also bring new challenges, particularly around securing enough power supply; as one analyst put it, location is as much about access to power as it is about land[11]. This energy constraint means some proposed data centres progress slowly, but the trend is firmly upward.

Overall, the industrial sector’s growth underscores its resilience even as other segments slow. BCI’s market data echoed this, showing industrial projects surging in early 2024 (over 250% year-on-year growth in early-stage project value, albeit from a low base)[12]. While that extraordinary jump partly reflects post-pandemic catch-up, it confirms strong investor interest in industrial assets.

From a supplier viewpoint, industrial projects can be lucrative in volume (lots of steel, concrete, equipment), but price-competitive. Many warehouse projects are design-and-construct with tight margins, so general contractors push for cost-effective solutions. Product trends in this space include greater use of prefabrication and modular construction to speed up builds (e.g., precast concrete wall panels, modular offices in warehouses). Sustainability is also creeping in – e.g., installation of solar PV panels on warehouse rooftops is now common, and some tenders specify battery storage or on-site renewable energy to mitigate huge power draws.

Sector Outlook: The industrial sector is expected to remain strong in the near term. Even if overall economic growth is modest, the structural drivers (online retail, data demand, infrastructure for the upcoming Brisbane 2032 Olympics, etc.) support continued investment. One caveat: as the Altus Group highlights, Australia’s infrastructure pipeline is significant but starting to decelerate beyond current projects[13], which could slightly temper industrial growth especially where projects tie into broader infrastructure. Nonetheless, many observers foresee industrial as one of the best-performing segments in 2025. Suppliers should continue to tailor solutions for this market – for example, offering energy-efficient equipment (to align with ESG goals) or fast-install systems (to meet rapid construction schedules). Keep an eye on power and sustainability requirements becoming standard in industrial tenders.

Industrial and logistics construction has provided a silver lining, delivering steady work and now a wave of data centers. Suppliers should note the shift: a warehouse today might require EV charging stations and solar roofs, not just racks and roller doors, reflecting a blend of traditional and high-tech specs. Those positioned in this sector are enjoying consistent demand across building materials, electrical systems, and automation tech.

Senior Data Analyst, E1

Retail and commercial buildings – subdued, transforming

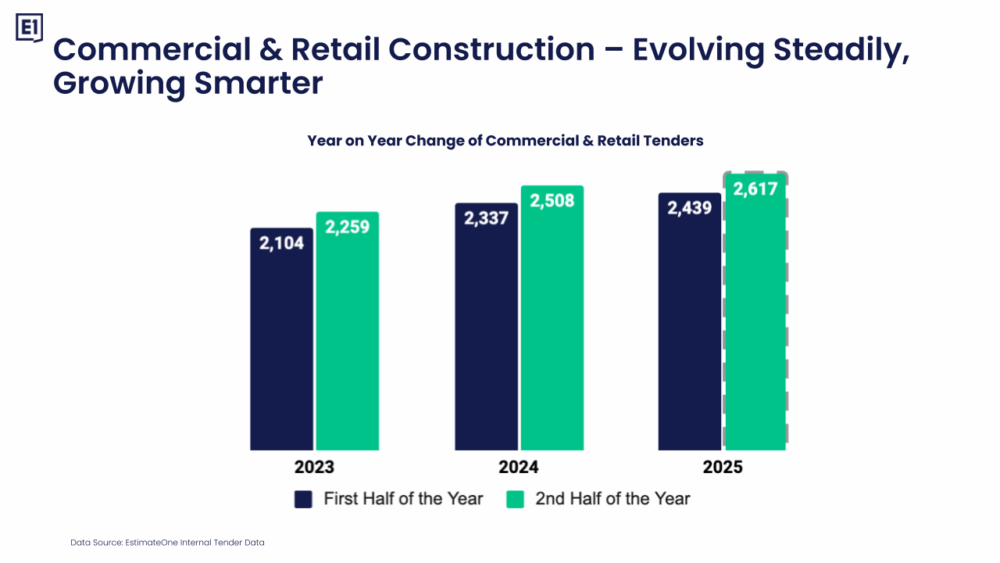

In contrast to the above sectors, retail construction (shopping centres, retail complexes) has been comparatively subdued. The era of mega-mall expansions has largely paused; rising interest rates, higher construction costs, and shifts in consumer behaviour (growth of online shopping) have made developers cautious about new retail builds. Over the last 6–12 months, tender volumes for pure retail projects were flat or slightly down (estimated 5% YOY decline, per simulated data). The projects that did move forward tended to be smaller-scale or renovation-focused – for example, refurbishing existing shopping centres, adding dining precincts, or re-purposing retail space for mixed-use (such as adding offices or residential above malls).

Office and commercial building activity has also faced headwinds. With many businesses reassessing office needs in a hybrid-work era, few new office towers have commenced outside of pre-committed projects. High financing costs have further dampened private commercial development. As a result, builders have been diversifying into other sectors: in a recent industry sentiment survey, diversifying into new project types (like healthcare, education, etc.) emerged as the top priority for builders in the coming year[14]. This shift is evident on the E1 (EstimateOne) platform too – many mid-tier builders known for retail/office work are now bidding on school or government projects to maintain volume.

That said, the retail/commercial segment is not completely idle. Activity is transforming rather than growing. We see, for instance, mixed-use developments that blend retail with residential or community facilities (libraries, childcare, etc.) – these appear in tenders as town centre redevelopments. There’s also a focus on refitting and upgrading: landlords are retrofitting offices with end-of-trip facilities, higher NABERS energy ratings, and modern amenities to attract tenants.

Some retail landlords are reconfiguring spaces (e.g. turning old department store floors into entertainment or medical precincts). These trends generate work for certain trades (interior fit-out contractors, facade upgrade specialists, etc.) and drive demand for products like modern facade cladding, energy-efficient lighting, elevators and HVAC upgrades.

Policy incentives are indirectly supporting some commercial works too – for example, city revitalisation grants or tax incentives for building improvements. Still, in the near term retail and office construction are the weakest links in the commercial sector. From a supplier’s perspective, sales in this category may require more proactive demand generation (as fewer big projects are out to tender) and a focus on renovation markets.

Sector Outlook: We anticipate retail and office construction to remain relatively soft until broader economic confidence and occupancy rates improve. One bright spot is specialised commercial facilities – e.g. life-sciences labs and healthcare-adjacent offices – which are actually growing due to post-pandemic investment (lab spaces, etc., often counted under commercial). Industry experts note that thriving subsectors like life-sciences and education-related facilities are filling some gap left by traditional commercial development[15][14]. Suppliers servicing retail/commercial projects should pivot to adaptive reuse and upgrade opportunities, and emphasise products that help building owners attract tenants (such as smart building systems, green building features).

In summary, this segment calls for a selective approach – the work is there, but in different forms than before.