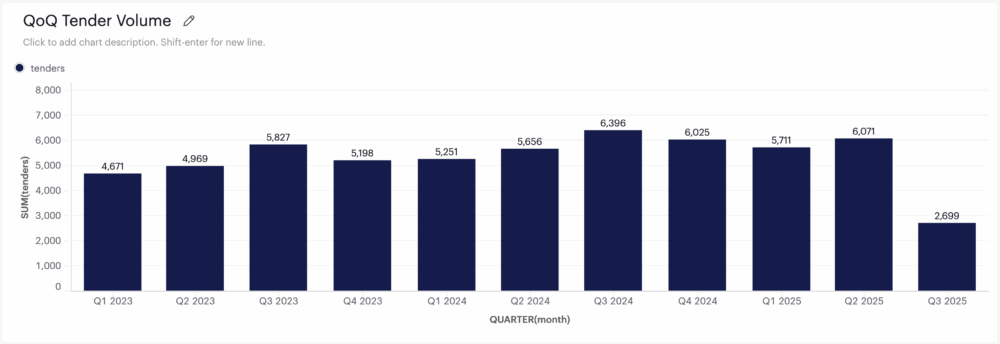

Overall tender activity in Australia’s commercial construction has been oscillating but stable over the past year. After a slight dip in mid-2023, tender volumes rebounded in late 2023 and early 2024. Figure 1 below illustrates the trend:

Figure 1: Quarterly Commercial Tender Count – 2023 to Q1 2024 (EstimateOne data)

Despite macroeconomic headwinds, the pipeline of upcoming work remains healthy. Notably, early-leading indicators are positive: according to BCI’s market intelligence, early-stage project approvals rose 43.4% year-on-year by mid-2024[16] (including many commercial building proposals). In Q2 2024 alone, new projects entering design phases jumped nearly 19% quarter-on-quarter[16] – a strong sign that future tender opportunities are on the way.

This resilience comes even as Australia’s economy saw only 0.1% GDP growth in Q1 2024 and faced high interest rates (RBA cash rate at 4.35% to curb inflation)[17]. In short, the construction sector’s pipeline is outperforming the broader economy, thanks in part to public infrastructure drives and pent-up demand in key sectors.

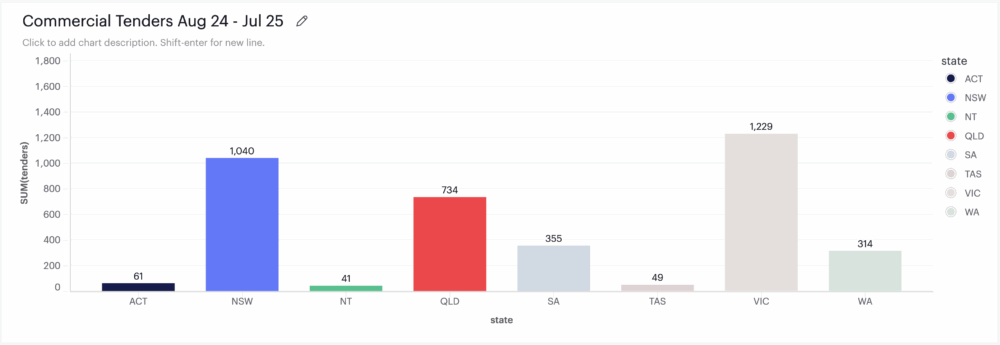

Geographically, a “two-speed” dynamic is evident. States like Queensland and Western Australia are experiencing a surge in construction activity, while New South Wales and Victoria have cooled slightly after record project booms in previous years[18]. Queensland’s pipeline is buoyed by major infrastructure and construction programs (e.g. transport projects and Olympics-related venues, as well as the hospital program noted earlier).

Many builders in QLD expect to increase workloads in the next 1–2 years, reflecting strong local demand[19]. In contrast, NSW and Victoria have seen some government spending cuts or deferrals – both states are reassessing capital works in light of budget constraints, leading to a lengthening of project pipelines and more competitive tendering for what does proceed[18]. Figure 2 provides a state-by-state breakdown of tender volumes (simulated example).

Figure 2: Commercial tenders by state (last 12 months)

Let’s recap the sectoral composition of tenders in numbers: public-funded sectors (education, health, community facilities) comprised a growing portion of tenders – roughly 40% of all commercial tenders in the last 2 quarters (simulated estimate), up from around 30% historically. Private commercial (offices, retail, hotels) made up perhaps 25%, with industrial/logistics and mixed-use projects making up the rest.

This shift illustrates how government and institutional clients are propping up the industry during a lull in purely private development.

It’s worth noting that project sizes vary widely. Many education tenders are mid-sized ($5–30 million) whereas hospital and infrastructure-linked projects can exceed $100 million. The tender counts treat them equally, but suppliers should weigh both count and total value of opportunities.

Some reports suggest total construction start values may dip in late 2024 (one forecast projects a temporary 46% drop in building commencements in Q4 2024 vs Q3[20], as a few mega-projects wind down), but this is likely a short-term fluctuation.

Overall, the national construction pipeline remains sizeable – albeit with timing and funding challenges on certain projects – and is expected to strengthen in late 2024 into 2025[21] (BCI forecasts a jump in commencements by Q4 2024, indicating a brighter 2025 ahead).

What this means for Aussie commercial construction suppliers

The tender trends suggest cautious optimism. There is no dramatic downturn in work; rather, a rebalancing towards publicly funded and industrial projects. Suppliers should track geographic and sectoral patterns – for instance, if you operate Australia-wide, allocate extra attention to Queensland opportunities right now, whereas in NSW/Victoria, expect more competition for fewer projects.

With the pipeline showing long-term strength (especially in infrastructure-adjacent building projects like schools and hospitals), positioning your company in those supply chains is key.

Moreover, anticipate the timing of tenders: many government projects follow budget cycles (peaking after budget approvals in Q3–Q4 each year). Using tools like E1 (EstimateOne)’s alerts for upcoming projects can help you stay ahead of these cycles.